Editorial

|

Supreme Court Ruling on Tariffs will not Dampen White House Policy

|

|

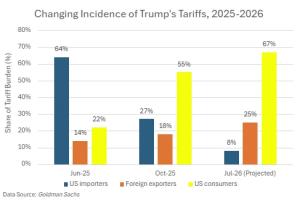

The February 20th Supreme Court of the United States (SCOTUS) ruling on tariffs was clear in its 6-3 majority decision to restrain the Administration from imposing tariffs. The Court concluded that the President was not empowered to apply the International Emergency Economic Powers Act of 1997 to impose tariffs. It was the decision of the majority that tariffs were effectively taxes and therefore the purview of Congress. The erratic imposition of tariffs on trading partners without any clear indication of a comprehensive strategy has impacted farmers and the U.S. agricultural economy. Tariffs especially if capricious result in retaliation and specifically impede exports of agricultural commodities where the U.S. is vulnerable. The February 20th Supreme Court of the United States (SCOTUS) ruling on tariffs was clear in its 6-3 majority decision to restrain the Administration from imposing tariffs. The Court concluded that the President was not empowered to apply the International Emergency Economic Powers Act of 1997 to impose tariffs. It was the decision of the majority that tariffs were effectively taxes and therefore the purview of Congress. The erratic imposition of tariffs on trading partners without any clear indication of a comprehensive strategy has impacted farmers and the U.S. agricultural economy. Tariffs especially if capricious result in retaliation and specifically impede exports of agricultural commodities where the U.S. is vulnerable.

The National Farmers Union stated, “Over the past year, tariffs have raised input costs, disrupted export markets and incurred retaliation against U.S. agricultural goods. In an already fragile farm economy, uncertainty has hit family operations hardest.”

Rep. Angie Craig (D-MN) the Ranking Member of the House Agriculture Committee welcomed the SCOTUS ruling although emphasizing the damage to farmers from reduced exports of agricultural commodities in the current season. She observed “Losses will take years to recover since markets have been handed to competitors like Argentine and Brazil.”

Scott Metzger, president of the American Soybean Association pointed to the double jeopardy of increased costs to farmers for imported fertilizer, seeds and pesticides coupled with declining export volume that has depressed unit prices. He stated “Moving forward, certainty and dependable market access will be essential for U.S. soy to remain competitive globally.” He added “We urge the President to refrain from imposing tariffs on agricultural imports using other authorities”

Despite the clear decision by SCOTUS, the Administration is pursuing alternative strategies to retain tariffs, the legality of which have yet to be tested. Congress has been remiss in imposing its constitutionally accorded authority over trade, encouraging the White House to adopt policies unhindered by restraint. Despite the SCOTUS ruling, it is anticipated that the issue with consequential and collateral damage will persist through prolonged litigation or until Congress exerts its authority. Despite the clear decision by SCOTUS, the Administration is pursuing alternative strategies to retain tariffs, the legality of which have yet to be tested. Congress has been remiss in imposing its constitutionally accorded authority over trade, encouraging the White House to adopt policies unhindered by restraint. Despite the SCOTUS ruling, it is anticipated that the issue with consequential and collateral damage will persist through prolonged litigation or until Congress exerts its authority.

Farmers have been placed at a competitive disadvantage with respect to their counterparts in Brazil, Argentina and other Latin American Nations with respect to supplying available markets. It appears that the Administration intends to reimburse farmers in tranches of public funding with an initial “bridging” amount of $12 billion to be followed by $25 billion. This will be at the expense of the national debt.

A fresh approach to tariffs is urgently required since White House policy has clashed with the law of unintended consequences. An “Eye-for-Eye” succession of tariffs will end up blinding all parties and generating hardship within the U.S. agricultural and industrial sectors.

|

|

Poultry Industry News

|

Brought to you by Val-Co Industries

|

|

This edition of CHICK-NEWS is sponsored by VAL-CO Industries. The featured posting describes the Comfort-Nest® designed to optimize hatching eggs per hen housed. The article includes a financial evaluation to justify the differential in cost over conventional side belt nest installations.

The February edition includes an editorial and commentary, statistical reports and news items and events of topical interest impacting the poultry meat industry.

|

VAL-CO Comfort Nest™

|

|

Mechanical nests are now the industry standard for producers of broiler hatching eggs. VAL-CO has developed and refined systems incorporating advanced U.S. and EU technology. Feedback from successful breeder managers is incorporated in the VAL-CO Comfort Nest™. This system provides hens with a laying environment contributing to clean shells. Acceptance of the nest system by flocks reduces floor eggs, maximizing income for the contractor and optimizing settable eggs, hatch and hence profit for integrators. Mechanical nests are now the industry standard for producers of broiler hatching eggs. VAL-CO has developed and refined systems incorporating advanced U.S. and EU technology. Feedback from successful breeder managers is incorporated in the VAL-CO Comfort Nest™. This system provides hens with a laying environment contributing to clean shells. Acceptance of the nest system by flocks reduces floor eggs, maximizing income for the contractor and optimizing settable eggs, hatch and hence profit for integrators.

The unique feature of the Comfort Nest™ is the 19-inch wide opening that attracts hens and provides additional space for high-yield broiler strains.

Features of the Comfort Nest™ installation include:-

- Two five-inch side belts with either polypropylene or fiber according to customer preference.

- Lids are hinged for inspection and cleaning.

- Automatic nest-closing operated by a winch and cables. This allows programmed closure before ‘lights-out’ and opening before the first morning feed

- Ventilated partitions contributing to comfort in hot weather.

- Optional PVC pipe kit to prevent expulsion of eggs when multiple hens pile into a nest.

- Nest bottoms are fabricated from galvanized wire that provides long life and the ability to support multiple hens.

- Available with NXT style turf nest pads.

- The Comfort Nest™ system is fabricated from galvanized metal and ammonia-resistant plastic components to ensure a prolonged operational life.

- Ease of access for decontamination and maintenance.

|

VAL-CO Comfort Nest installation with nest openings closed

VAL-CO Comfort Nest installation with wide entry to nests open

19" wide opening attracts hens to Comfort Nests

Hens are attracted to VAL-CO Comfort Nests

|

In comparing the cost of a conventional nest installation with the Comfort Nest™ system it is calculated that the differential in capital cost is approximately $5,000 for a house holding 11,500 hens. Field data shows between 5 and 10 additional hatching eggs harvested per hen-housed over a laying cycle through 64 weeks of age. The benefit is due to a reduction in floor eggs that invariably have soiled shells and undergo shell damage.

Assuming a conservative five additional eggs per hen housed, the contractor would earn an incremental $2,875 per cycle extending over 52 weeks (including pre-lay and clean-out), assuming a payment of $0.60 per dozen. In addition, the labor required to gather and attempt to dry-clean eggs is mostly eliminated with the Comfort Nest® system. The additional $5,000 capital cost represents an annual fixed cost of $1,000 comprising interest at 5 percent per annum and depreciation at 15 percent per annum. Selection of the Comfort Nest™ would provide the contractor with a 20 month pay-back period on a cash-flow basis. Applying a discount factor of 5 percent to the net annual benefit of $1,875 per cycle the 10-year net present value of the initial incremental $5,000 investment is $13,833. This calculation assumes stable contractor payment. With inevitable inflation the differential favoring the more productive Comfort Nest® will increase proportionally to income.

From the perspective of the integrator, a contractor with a flock of 11,500 hens producing an incremental five hatching eggs per hen housed would place an additional 46,000 broiler chicks per cycle assuming 80 percent average hatch. The benefit would accrue in the incremental margin from RTC product that would depend on live weight of broilers harvested, product range and price structure.

Feedback from the Field

A broiler breeder manager for a leading integrator provided feedback on the operation of the VAL-CO Comfort Nest®: -

- Birds are receptive to the Comfort Nest that allows more than one bird to occupy a single nest.

- We have seen a sharp reduction in the number of floor eggs in a typical 500-foot house with 12,000 hens. We might see 30 floor eggs with a Comfort Nest installation compared to as many as 130 with standard side-belt nests.

- We rarely have issues with operation since the nest installation is reliable. Contractors report consistent daily operation over three flocks.

- Contractors have no complaints as compared to other nest systems with installation and labor is in line with other brands.

- VAL-CO provides assistance and advice to fix any issues that arise.

|

Monthly Broiler Production Statistics, January-February

|

|

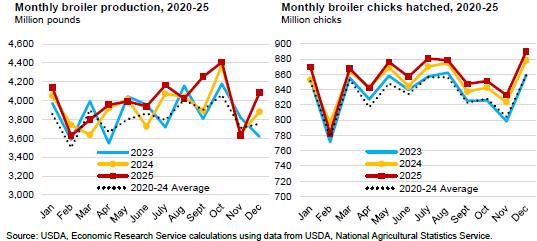

Broiler Chick Placements, January-February 2026

According to the February 18th 2026 USDA Broiler Hatchery Report, 1,268 million eggs were set over five weeks extending from January 17th through February 14th 2026 inclusive. This was approximately two percent higher compared to the corresponding period in 2025.

Total chick placements for the U.S. over the five-week period amounted to 979 million chicks. Claimed hatchability for the period averaged 79.2 percent for eggs set three weeks earlier. Each 1.0 percent change in hatchability represents approximately 1.96 million chicks placed per week and 1.86 million broilers processed, assuming five percent culls and mortality and within the current range of weekly settings.

Cumulative chick placements for the period January 4th through December 27th 2025 amounted to 10.00 billion chicks up approximately one percent from calendar 2024. Chick placements for 2026 to date have attained 1.18 billionin 2026 to date, up two percent from the corresponding period in 2025.

According to the February 23rd 2025 edition of USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during January 2026 amounted to 8.10 million, up 4.2 percent (0.36 million pullet chicks) from January 2025. Broiler breeder hen complement attained 60.55 million on February 1st 2026, 2.2 percent (1.38 million hens) down from January 2025 but 0.6 percent (343,000 hens) higher than January 2026.

Broiler Production 2026

As documented in the February 19th 2026 USDA Weekly Poultry Slaughter Reports for the processing week ending February 14th 2026, 172.2 million broilers were processed at 6.52 lbs. live. This was 3.5 percent more than the 166.8 million processed during the corresponding week in February 2025. Broilers processed in 2026 to date amounted to 1.117 million, 4.0 percent less than the 1.131 million during the corresponding period in 2025.

Ready to cook (RTC) weight for the most recent week in February was 853.2 million lbs. (386,925 metric tons). This was 2.8 percent more than the 830.1 million lbs. during the corresponding week in February 2025. Dressing percentage was a nominal 76.0 percent. For 2026 to date RTC broiler production attained 5,888 million lbs. (2.670 million metric tons). This quantity was 3.6 percent more than for the corresponding period in 2025.

The USDA posted live-weight data for the past week ending February 14th and YTD 2026 including:-

|

Live Weight Range (lbs.)

|

<4.25

|

4.26-6.25

|

6.26-7.25

|

>7.76

|

|

Proportion past week (%)

|

14

|

34

|

22

|

30

|

|

Change from 2020 YTD (%)

|

-1

|

0

|

+9

|

+7

|

November 2025 Frozen Inventory

According to the February 24th 2026 USDA Cold Storage Report, stocks of broiler products as of January 31st 2026 compared to January 31st 2025 showed differences with respect to the following categories:-

- Total Chicken category attained 794.7 million lbs. (360.4 thousand metric tons) corresponding to approximately one week of production based on recent weekly RTC output. The January 31st 2026 inventory was down 1.2 percent compared to 803,966 million lbs. (346.6 thousand metric tons) on January 31st 2025 and down 3.7 percent from the previous month of December 2025.

- LegQuarters were down 27.6 percent to 47.8 million lbs. compared to January 31st 2025 consistent with the data on exports. Inventory was down 6.7 percent from December 31st Given the trend in inventory of leg quarters it is evident that this category continues to be shipped in varying quantities as the principal (96 percent) chicken export product to a number of nations.

- The Breasts and Breast Meat category was down 5.9 percent from January 31st 2025 to 234.1 million lbs. indicating a relatively higher domestic consumer demand for this category possibly reflecting concern over inflation in the cost of alternative proteins. The January 31st 2026 stock level was 4.1 percent lower than December 31st The trend through 2025 suggests stable retail and food service demand for the white meat category. This is despite promotion of chicken sandwiches and wraps by QSRs in the face of a higher cost for beef coupled with an increasing pattern of eat-at-home consumption.

- Total inventory of dark meat (drumsticks legs, thighs and thigh quarters but excluding leg quarters) on January 31st 2026 decreased 8.3 percent from January 31st 2025 to 64.1 million lbs. This difference suggests an increase in domestic demand for lower-priced dark meat against the prevailing price of white chicken meat. Higher prices for competitive proteins offer an opportunity to increase domestic demand for this category with innovative product development and promotion.

- Wings showed a 6.2 percent decrease from January 31st 2025, contributing to a stock of 50.7 million lbs. Inventory of wings was 7.7 percent lower compared to the end of December 2025. Movement in stock over the past 12 months has demonstrated slightly higher demand for this category despite competition from “boneless wings.” Increased consumption traditionally associated with significant sports events including College bowls and the NFL Super Bowl traditionally reduce the volumes of storage in January and February. Unit price increased progressively during 2024 but plateaued in 2025 due to consumer fatigue and competition from competing protein snacks despite continued interest in professional and collegiate football.

- The inventory of Paws and Feet was 21.2 percent lower than on January 31st 2025 to 27.1 million lbs. Stock was 1.6 percent lower than on December 31st Prior to the April 2020 Phase-1 Trade Agreement approximately half of the shipments of paws and feet destined for Hong Kong were landed and transshipped to the Mainland, a trend that is re-emerging.

- The Other category comprising 347.6 million lbs. on January 31st 2026 was up 10.2 percent from January 31st 2025 but represented a substantial 42.7 percent of inventory. The high proportion of the Other category suggests further classification or re-allocation by USDA to the designated major categories.

January 2026 Processed Broiler Production

The monthly USDA Poultry Slaughter Report was released on February 20th 2025 covering January 2026. The month comprised 22 week-days, one less than January 2025. The following values were documented for the month of January 2026:-

- A total of 799.1 million broilers were processed in January 2026, down 25.1 million or 3.0 percent from January 2025;

- Total live weight in January 2026 was 5,324 million lbs., down 155.8 million lbs. or 2.8 percent from January 2025;

- Unit live weight in January 2026 was 6.66 lbs., up 0.01lb. (0.2 percent) from January 2025.

- RTC in January2026 attained 4,033 million lbs., down 107.3 million lbs. or 2.6 percent from January 2006.

- WOG yield in January 2026 was 75.8 percent, up from 75.6 percent in January 2025.

- The proportion marketed as chilled in January 2026 comprised 93.2 percent of RTC output compared to 93.6 percent in January 2025.

- Ante-mortem condemnation as a proportion of live weight attained 0.21 percent during January 2026 unchanged from January 2025.

- Post-mortem condemnations as a proportion of processed mass corresponded to 0.45 percent during January 2026 compared to 0.48 percent in January 2025.

Comments

Mexico has recognized the OIE principle of regionalization after intensive negotiations between SENASICA and the U.S. counterpart, USDA-APHIS assisted by USAPEEC. Provided importing nations adhere to OIE guidelines on regionalization, localized outbreaks of avian influenza or possibly Newcastle disease will affect exports only from states or counties with outbreaks in commercial flocks. The response of China, Japan and some other nations is less predictable with bans placed on a nationwide or statewide basis. The response by China to outbreaks is influenced more by self-interest than considerations of scientific fact or international trade obligations. Other importing nations have confined restrictions to counties following the WOAH principle of regionalization. The challenge facing the U.S. as the second largest exporting nation after Brazil, will be to gain acceptance for controlled vaccination against HPAI in specific industry sectors and regions with appropriate surveillance and certification to the satisfaction of importing nations.

|

|

U.S. Broiler and Turkey Exports, January Through November 2025

|

|

OVERVIEW

Total exports of bone-in broiler parts and feet during January-November 2025 attained 2,868,161 metric tons, 4.0 percent lower than in January-November 2024 (2,986,653 metric tons). Total value of broiler exports decreased by 0.6 percent to $4,281 million ($4,307 million).

Total export volume of turkey products during January-November 2025 attained 173,676 metric tons, 14.8 percent less than in January-November 2024 (203,861 metric tons). Total value of turkey exports increased by 15.9 percent to $715 million ($617 million).

Average unit price attained by the broiler industry is constrained by the fact that leg quarters comprise over 96 percent of broiler meat exports by volume (excluding feet). Leg quarters represent a relatively low-value undifferentiated commodity lacking in pricing power. Exporters of commodities are subjected to competition from domestic production in importing nations. Generic products such as leg quarters are vulnerable to trade disputes and embargos based on real or contrived disease restrictions. To increase sales volume and value the U.S. industry will have to become more customer-centric offering value-added presentations with attributes required by importers. Whether this will increase margins is questionable given that leg quarters are regarded by U.S. integrators as a by-product of broiler production. A more profitable long-term strategy for the U.S. industry would be to develop products using dark meat to compete with and displace pork and beef in the domestic retail and institutional markets. Due to a shortage and hence high price for beef products this opportunity is now evident.

HPAI is now accepted to be panornitic affecting the poultry meat industries of six continents with seasonal and sporadic outbreaks. The incidence rate and location of cases in the U.S. has limited the eligibility for export from many plants depending on restrictions imposed by importing nations. Incident cases in the U.S. continued at a low rate in egg-production flocks and in turkeys during late 2025 but a resurgence is evident during the first quarter of 2026.

Uncertainty surrounding tariff policy is an added complication potentially impacting export volume in 2026. In the event of reduced exports, leg quarters would be diverted to the domestic market resulting in a depression in average value derived from a processed bird.

To offset an anticipated decline in exports of U.S. agricultural products the USDA will make available $285 million during 2026 for trade promotion including trade reciprocity missions and credit guarantees under the GSM-102 program. The USAPEEC received $7.0 million for export promotion for FY 2026. Of this total, $5.8 million was through the Market Access Program (MAP) and $1.2 million through the Foreign Market Development Program (FMDP). For FY 2026 The USDA will distribute $181 million among 68 industry associations under the MAP and $31 million under the FMDP to 18 organizations.

EXPORT VOLUMES AND PRICES FOR BROILER MEAT

During 2025 the National Chicken Council (NCC), citing USDA-FAS data, documented exports of 3,171,206 metric tons of chicken parts and other forms (whole and prepared), down 3.8 percent from January-December 2024. Exports were valued at $4,764 million with a weighted average unit value of $1,503 per metric ton.

The NCC breakdown of chicken exports for 2025 by proportion and unit price for each category compared with the corresponding months in 2024 (with the unit price in parentheses) comprised:-

- Chicken parts (excluding feet) 1%; Unit value $1,395 per metric ton ($1,365)

- Prepared chicken 0%; Unit value $4,640 per metric ton ($4,244)

- Whole chicken 9%; Unit value $1,688 per metric ton ($1,755)

- Composite Total 0%; Av. value $1,503 per metric ton ($1,466)

The following table prepared from USDA data circulated by the USAPEEC, compares values for poultry meat exports during January-November 2025 compared with the corresponding months during 2024:-

|

PRODUCT

|

Jan.-Nov. 2024

|

Jan.-Nov. 2025

|

DIFFERENCE

|

|

Broiler Meat & Feet

|

|

|

|

|

Volume (metric tons)

|

2,986,653

|

2,868,161

|

-118,492 (-4.0%)

|

|

Value ($ millions)

|

4,307

|

4,281

|

-26 (-0.6%)

|

|

Unit value ($/m. ton)

|

1,442

|

1,492

|

+50 (+3.5%)

|

|

Turkey Meat

|

|

|

|

|

Volume (metric tons)

|

203,861

|

173,626

|

-30,235 (-14.8%)

|

|

Value ($ millions)

|

617

|

715

|

+101 (+16.5%)

|

|

Unit value ($/m. ton)

|

3,027

|

4,118

|

+1,091 (+36.0%)

|

COMPARISON OF U.S. CHICKEN AND TURKEY EXPORTS

JANUARY-NOVEMBER 2025 COMPARED TO 2024

BROILER EXPORTS

Total broiler parts, predominantly leg quarters but including feet, exported during January-November 2025 compared with the corresponding months in 2024 declined by 4.0 percent in volume and value was down 0.6 percent. Unit value was 3.5 percent higher to $1,492 per metric ton.

For comparison during 2024 exports attained 3,251,000 metric tons valued at $4,689 million, down 10.5 percent in volume and down 1.1 percent in value compared to 2023. Unit value was up 10.7 percent to $1,442 per metric ton

Broiler imports in 2025 are projected to attain an inconsequential 67,000 metric tons (134 million lbs.) compared to 82,000 metric tons (180,000 million lbs.) in 2024

The top five importers of broiler meat represented 50.2 percent of shipments during January-November 2025. The top ten importers comprised 66.2 percent of the total volume reflecting concentration among the significant importing nations.

Third-ranked Cuba imported 209,639 metric tons over 11 months representing 7.3 percent of shipments that were valued at $265 million with a unit price of $1,264 per metric ton. Volume and value were respectively 7.3 and 6.4 percent lower than for the corresponding period in 2024. Continued trade with Cuba is imperiled by declining economic strength. Their capicity to import was recently exacerbated by the energy crisis resulting from action in Venezuela and U.S. policy on the supply of fuel to the nation.

Eighth-ranked China declined 44.7 percent in volume to 85,183 tons and concurrently by 31.3 percent in value to $262 million over the first eleven months of 2025 compared to the corresponding period in 2024. Unit value increased by 15.0 percent to $3,075 per metric ton reflecting the high proportion of feet in consignments

Nations gaining in volume compared to the corresponding period in 2024 (with the percentage change indicated) in descending order of volume with ranking indicated by numeral were:-

- Taiwan, (+29%); 4. Philippines, (+29%); 5. Canada, (+12%); 10. UAE, (+5); 11.Ghana, (+18%); 12. Haiti, (+25%); 13, Dominican Rep., (+5%) and 16. Congo-Kinshasa), (+101%)

Losses during January-November 2025 offset the gains in exports with declines for:-

- Mexico, (-7%); 3. Cuba, (-9%); 6. Guatemala, (-2%); 7. Angola, (-15%);

- China, (-45%); 9. Viet Nam, (-33); 14. Hong Kong, (-36%) and 15. Columbia, (-2 %).

TURKEY EXPORTS

The volume of turkey meat exported during January-November 2025 declined by 14.8 percent to 173,676 metric tons from the 11 months of 2024 but value was 15.9 percent higher at $715 million. Average unit value was 36.0 percent higher at $4,115 per metric ton.

Imports of turkey products attained 15,000 metric tons (33 million lbs.) in 2024 with a similar projection for 2025.

Mexico imported 137,717 tons during the 11-month period representing 79.3 percent of volume. Value attained $578 million comprising 79.5 percent of revenue at a unit price of $4,124 per ton. Canada imported 5,654 tons (3.3 percent of exports) valued at $20 million with a unit price of $3,573 per ton.

It is important to recognize that exports of chicken and turkey meat products to our USMCA partners amounted to $1,264 million in 2021, $1,647 million during 2022, $1,696 in 2023 and $1,887 million over the first eleven months of 2025. It will be necessary for all three parties to the USMCA to respect the terms of the Agreement in good faith since punitive action against Mexico or Canada on issues unrelated to poultry products will result in reciprocal action by our trading partners to the possible detriment of U.S. agriculture.

The emergence of H5N1strain avian influenza virus with a Eurasian genome in migratory waterfowl in all four Flyways of the U.S. during 2022 was responsible for sporadic outbreaks of avian influenza in backyard flocks and serious commercial losses in egg-producing complexes and turkey flocks but to a lesser extent in broilers. The probability of additional outbreaks of HPAI over succeeding weeks appears likely with recorded outbreaks in turkey farms in ND, SD and MN. Consistent with fall migration of waterfowl. Incident cases affecting egg-production and turkey flocks will be a function of shedding by migratory and domestic birds and possibly free-living mammals or even extension from dairy herds. Protection of commercial flocks at present relies on the intensity and efficiency of biosecurity including wild-bird laser repellant installations, representing investment in structural improvements and operational procedures. These measures are apparently inadequate to provide absolute protection, suggesting the need for preventive vaccination in high-risk areas for egg-producing, breeder and turkey flocks.

The application of restricted county-wide embargos following the limited and regional cases of HPAI in broilers with restoration of eligibility 28 days after decontamination has supported export volume for the U.S. broiler industry. Exports of turkey products were more constrained with plants processing turkeys in Minnesota, the Dakotas, Wisconsin and Iowa impacted. The future challenge will be to gain acceptance for limited preventive vaccination of laying hens and turkeys in high-risk areas accompanied by intensive surveillance. It is now accepted that H5N1 HPAI is panornitic in distribution among commercial and migratory birds across six continents. The infection is now seasonally or regionally endemic in many nations with intensive poultry production, suggesting that vaccination will have to be accepted among trading partners as an adjunct to control measures in accordance with WOAH policy.

The live-bird market system supplying metropolitan areas, the presence of numerous backyard flocks, gamefowl and commercial laying hens allowed outside access, potentially in contact with migratory and now some resident bird species, all represent an ongoing danger to the entire U.S. commercial industry. The live-bird segments of U.S. poultry production represent a risk to the export eligibility of the broiler and turkey industries notwithstanding WOAH compartmentalization for breeders and regionalization (zoning) to counties or states for commercial production.

|

Updated USDA-ERS February 2026 Poultry Meat Projection

|

|

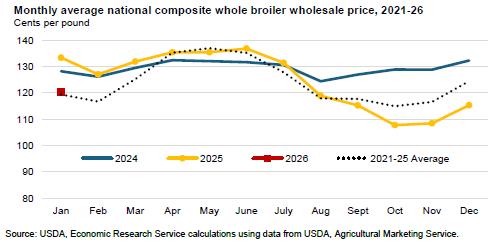

On February 17th 2026 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering actual 2024, a projection for 2025 and a forecast for 2026. On February 17th 2026 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering actual 2024, a projection for 2025 and a forecast for 2026.

The revised 2025 projection for broiler production is for 48,003 million lbs. (21.770 million metric tons) up 2.1 percent from 2024. USDA projected per capita consumption of 102.9 lbs. (45.7 kg.) for 2025, up 1.8 percent from 2024. Exports will attain 6,660 million lbs. (3.020 million metric tons), 0.3 percent below the previous year.

The 2026 USDA forecast for broiler production will be 48,500 million lbs. (21.996 million metric tons) up 1.0 percent from 2025 with per capita consumption up 0.9 percent to 103.8 lbs. (46.6 kg). Exports will be 1.5 percent higher compared to 2025 at 6,670 million lbs. (3.025 million metric tons), equivalent to 13.8 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2024

(actual)

|

2025

(projection)

|

2026

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,994

|

48,003

|

48,500

|

+2.1

|

|

Consumption (lbs. per capita)

|

101.1

|

102.9

|

103.8

|

+1.8

|

|

Exports (million lbs.)

|

6,680

|

6,660

|

6,670

|

-0.3

|

|

Proportion of production (%)

|

14.2

|

13.9

|

13.8

|

-2.1

|

| |

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,121

|

4,844

|

4,965

|

-5.4

|

|

Consumption (lbs. per capita)

|

13.8

|

13.2

|

13.4

|

-4.5

|

|

Exports (million lbs.)

|

486

|

417

|

400

|

-14.1

|

|

Proportion of production (%)

|

9.5

|

8.6

|

8.1

|

-9.5

|

Source: Livestock, Dairy and Poultry Outlook released Feb 17th 2026

The February 17th USDA report updated the projection for the turkey industry during 2025 including annual production of 4,844 million lbs. (2.197 million metric tons), down 5.4 percent from 2024. Consumption in 2025 is projected to be 13.2 lbs. (6.0kg.) per capita, down by 4.3 percent from the previous year. Export volume will attain 417 million lbs. (189,116 metric tons) in 2025. Values for production and consumption of RTC turkey in 2025 and 2026 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, trends in production levels, losses from HPAI and inventories consistent with season.

The 2026 forecast for turkey production is 4,965 million lbs. (2.251 million metric tons) up an optimistic 2.5 percent from 2025 with per capita consumption up 1.5 percent to 13.4 lbs. (6.1 kg). Exports will be 4.1 percent lower than in 2025 to 400 million lbs. (181,406 metric tons) equivalent to 8.0 percent of production. This implies a reduction in selling prices for whole birds and products

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations

|

Hormel Foods to Exit Whole-Bird Turkey Production

|

|

In a February 17th announcement, Hormel Foods Corp. confirmed that it will sell the Melrose, MN. Whole-bird plant and the Swanville, MN. feed mill and related assets including vehicles to Life-Science Innovations. The purchaser will assume contracts with growers and provide Hormel with turkey meat through to the end of Fiscal 2026. Hormel will retain the Jennie-O brand and will concentrate on further-processed and turkey-derived added-value products. As motivation for the transaction, Hormel noted concern over fluctuation in commodity markets and the losses associated with HPAI that have impacted central Minnesota. In a February 17th announcement, Hormel Foods Corp. confirmed that it will sell the Melrose, MN. Whole-bird plant and the Swanville, MN. feed mill and related assets including vehicles to Life-Science Innovations. The purchaser will assume contracts with growers and provide Hormel with turkey meat through to the end of Fiscal 2026. Hormel will retain the Jennie-O brand and will concentrate on further-processed and turkey-derived added-value products. As motivation for the transaction, Hormel noted concern over fluctuation in commodity markets and the losses associated with HPAI that have impacted central Minnesota.

In recent years, reorganization by Hormel has obscured any evaluation of the financial performance of the Jennie-O business. Hormel noted in their release that the  divestment would have no material impact on FY 2026 earnings. In a preliminary first quarter 2026 release on February 17th, the company expects Q1 net sales of $3 billion, organic net sales growth of two percent and Q1 diluted EPS of $0.33. Jeff Ettinger, Interim CEO, stated “We are pleased with our preliminary first quarter results.” He added, “They reflect a solid start to the year and are aligned with our expectations and give us confidence that we are focused on the right initiatives to return Hormel Foods to profitable growth.” divestment would have no material impact on FY 2026 earnings. In a preliminary first quarter 2026 release on February 17th, the company expects Q1 net sales of $3 billion, organic net sales growth of two percent and Q1 diluted EPS of $0.33. Jeff Ettinger, Interim CEO, stated “We are pleased with our preliminary first quarter results.” He added, “They reflect a solid start to the year and are aligned with our expectations and give us confidence that we are focused on the right initiatives to return Hormel Foods to profitable growth.”

|

Costco Faces Legal Issues

|

|

On January 22nd, a class-action lawsuit was filed against Costco Wholesale Corp., et. al, in the U.S. District Court for the Southern District of California. The Plaintiffs, Johnston, et. al, claim that the Costco “No preservative” claim for Kirkland Signature Seasoned Rotisserie Chicken was misleading. Carrageenan, a natural compound extracted from seaweed and sodium phosphate, a common chemical used in food processing, were added to the product as a stabilizer and preservative respectively to extend quality and shelf stability. The Plaintiffs allege that Costco took advantage of consumers seeking “clean label” descriptors of the product. On January 22nd, a class-action lawsuit was filed against Costco Wholesale Corp., et. al, in the U.S. District Court for the Southern District of California. The Plaintiffs, Johnston, et. al, claim that the Costco “No preservative” claim for Kirkland Signature Seasoned Rotisserie Chicken was misleading. Carrageenan, a natural compound extracted from seaweed and sodium phosphate, a common chemical used in food processing, were added to the product as a stabilizer and preservative respectively to extend quality and shelf stability. The Plaintiffs allege that Costco took advantage of consumers seeking “clean label” descriptors of the product.

Following filing of the lawsuit, Costco amended the label of their $4.99 iconic rotisserie chicken. The company stated, “To maintain consistency among the labeling on our rotisserie chicken and the signs in our warehouses and on-line presentations, we removed statements concerning preservatives.”

Wesley Griffith, Esq., managing partner of the Almeida Law Group, the plaintiff’s attorney commented, “It is confirmation of our core legal theory that “the no preservative” claims were false.

This case exemplifies the mendacity of the California tort bar that constantly searches for “shake-down” cases in which Plaintiffs do not suffer any damage but take advantage of them and defendants in pursuing spurious claims. Both sodium phosphate and carrageenan improve the organoleptic qualities of product and are approved for use in food processing.

A second legal issue confronting Costco relates to the levels of Salmonella as documented by the USDA FSIS in chicken produced at Lincoln Premium Poultry. This complex is owned by Costco and is the supplier of a high proportion of rotisserie chickens sold in Costco warehouses. Two lawsuits have been filed to date relating to contamination although there is no epidemiologic evidence that outbreaks of salmonellosis have occurred as a result of consuming Costco rotisserie chicken. The second lawsuit filed in the U.S. District Court in Seattle on February 12th alleges “economic injury” by overpaying for the potentially contaminated chicken purchased after January 1st, 2019, the year of inception of production by Lincoln Premium Poultry. The complaint draws heavily on a December 2025 document prepared by Farm Forward, an activist group opposed to all forms of intensive livestock production. It is a matter of record that Lincoln Premium Poultry has been classified by the USDA among Category 3 plants over an extended period. This suggests structural and operational problems that should be addressed to enable the plant to conform to industry norms with respect to contamination of carcasses and parts. A second legal issue confronting Costco relates to the levels of Salmonella as documented by the USDA FSIS in chicken produced at Lincoln Premium Poultry. This complex is owned by Costco and is the supplier of a high proportion of rotisserie chickens sold in Costco warehouses. Two lawsuits have been filed to date relating to contamination although there is no epidemiologic evidence that outbreaks of salmonellosis have occurred as a result of consuming Costco rotisserie chicken. The second lawsuit filed in the U.S. District Court in Seattle on February 12th alleges “economic injury” by overpaying for the potentially contaminated chicken purchased after January 1st, 2019, the year of inception of production by Lincoln Premium Poultry. The complaint draws heavily on a December 2025 document prepared by Farm Forward, an activist group opposed to all forms of intensive livestock production. It is a matter of record that Lincoln Premium Poultry has been classified by the USDA among Category 3 plants over an extended period. This suggests structural and operational problems that should be addressed to enable the plant to conform to industry norms with respect to contamination of carcasses and parts.

Previously, Costco was embroiled in claims and litigation arising from salmonellosis but the chicken in question was supplied by a West Coast integrator and preceded the establishment of Lincoln Premium Poultry.

Given the possibility of viable Salmonella being present on uncooked carcasses and parts, it is necessary for consumers, restaurants and especially for in-store rotisserie preparation of chicken to ensure that appropriate handling and heating to 165 F for at least 30 seconds is achieved. Given the sale of two million rotisserie chickens each week from Liberty Premium Poultry in Costco warehouses, the absence of Salmonella outbreaks attributed to the product, it is to be assumed that Costco is adequately cooking their rotisserie chicken and selling a wholesome product.

The allegations contained in the Farm Forward release relating to stocking density, scale of operation and management of flocks contributing to Salmonella contamination are essentially spurious. The contentions of the author represent oft-repeated and scientifically unsubstantiated opinions of Animal rights activists that lack merit. Unfortunately the statements supported by plaintiffs’ experts but will be used to sway uninformed but confused jurors.

This case has overtones of the ongoing glyphosate litigation. If unfavorable verdicts are handed down, it should be expected that a cascade of similar lawsuits will be filed targeting the largest U.S. integrators regarding advertizing claims on welfare, sustainability and other attributes.

|

Development of a Vector H5N1 Vaccine

|

|

According to a preliminary notification in Cell Reports Medicine, a potentially effective vaccine was evaluated to protect rodents from H5N1 avian influenza infection.

The vaccine comprised a chimpanzee adenoviral virus as a vector stimulating immunity against H5 hemagglutinin antigen. Administration of the vaccine to mice resulted in a neutralizing antibody response. Protection was demonstrated against challenge with a human-derived H5N1 isolate (A/Michigan/90/2024 clade 2.3.4.4b), presumably derived from a worker exposed to avian influenza H5N1. The intranasal adenoviral-vectored vaccine provided a higher level of protection compared to intramuscular administration of hamsters subjected to challenge with Michigan and Texas isolates of H5N1.

It is hoped that this technology could be extended and evaluated in chickens and turkeys with an appropriate vector. The industry would benefit from any novel vaccine in addition to existing commercial vector products for mass primary immunization of broilers at the hatchery or via the intranasal route during rearing of layer and breeder pullets.

|

Funding for Export Programs

|

|

The USA Poultry and Egg Export Council was awarded $7 million by the USDA-Foreign Agricultural Service to promote exports of poultry and eggs. USDA has now released funds allocated by Congress for both the Market Access and the Foreign Market Development programs. The USA Poultry and Egg Export Council was awarded $7 million by the USDA-Foreign Agricultural Service to promote exports of poultry and eggs. USDA has now released funds allocated by Congress for both the Market Access and the Foreign Market Development programs.

In commenting on the awards, Greg Tyler, CEO of USAPEEC, stated “We are grateful to USDA- Foreign Agricultural Service for its ongoing support of our organization and global programs.”

|

Successful Vaccination of Ducks Against HPAI in France

|

|

During November 2024, the European Association of State Veterinary Offices noted that following initiation of vaccination against HPAI in ducks, outbreaks were effectively curtailed. Through November 2024, 61 million ducks had been vaccinated with ten outbreaks compared to an anticipated 480 outbreaks that would have occurred based on losses during the 2021-2022 HPAI season. During this period, there were 1,400 outbreaks resulting in culling of 22 million birds mainly in the concentrated foie gras industry. During November 2024, the European Association of State Veterinary Offices noted that following initiation of vaccination against HPAI in ducks, outbreaks were effectively curtailed. Through November 2024, 61 million ducks had been vaccinated with ten outbreaks compared to an anticipated 480 outbreaks that would have occurred based on losses during the 2021-2022 HPAI season. During this period, there were 1,400 outbreaks resulting in culling of 22 million birds mainly in the concentrated foie gras industry.

Expenditure on vaccination including vaccine, administration, monitoring, surveillance and veterinary supervision amounted to $122 million but saved close to $1.5 billion that would have been expended for control and decontamination. The $2 cost per duck appears excessive. In the context of the U.S. poultry industry, Both direct and some indirect costs would probably be less than 20 cents per bird given new-generation vector vaccines suitable for mass administration. Expenditure on vaccination including vaccine, administration, monitoring, surveillance and veterinary supervision amounted to $122 million but saved close to $1.5 billion that would have been expended for control and decontamination. The $2 cost per duck appears excessive. In the context of the U.S. poultry industry, Both direct and some indirect costs would probably be less than 20 cents per bird given new-generation vector vaccines suitable for mass administration.

Initially, the foie gras industry in France experienced negative responses from importers but it is noted that import embargos were in any event in effect due to clinical outbreaks of HPAI.

With experience and presentation of epidemiologic data and greater understanding of the ongoing HPAI pandemic, restrictions on importation from France and other nations applying HPAI vaccination have been eased.

|

QUARTERLY RESULTS FOR TYSON FOODS AND PILGRIM’S PRIDE

|

|

The two largest U.S.-based public-quoted broiler producers recently published quarterly results. Tyson data confirms the disproportionate profitability of chicken in comparison to other animal-derived protein.

|

|

Tyson Foods Inc. (TSN) February 2nd release

| Parameter |

Q1 2026 |

Q3 2024 |

| Revenue (m) |

$14,313 |

$13,623 |

| Net income (m) |

$37 |

$112 |

| Diluted EPS |

$0.24 |

$1.01 |

| Gross margin % |

5.6 |

8 |

| Operating margin % |

2.1 |

4.3 |

| Profit margin % |

0.6 |

2.6 |

| Total assets (m) |

$36,019 |

$36,658 |

| Long-term debt (m) |

$3,307 |

$3,421 |

| Market cap (m) |

$9,720 |

$12,906. (February 22nd 2026.) |

TSN broiler segment represented:-

29.4% of sales ($14,313m).

82.7% of operating income. ($450m)

|

|

|

Pilgrims Pride Corporation (PPC) February 22nd release

| Parameter |

Q4 2025 |

Q4 2024 |

| Revenue (m) |

$4,518 |

$4,372 |

| Net income (m) |

$88 |

$235 |

| Diluted EPS |

$0.37 |

$0.99 |

| Gross margin % |

9.5 |

15.2 |

| Operating margin % |

10.8 |

10.7 |

| Profit margin % |

1.9 |

5.4 |

| Total assets (m) |

$10,344 |

$10,651.00 |

| Long-term debt (m) |

$3,307 |

$3,421 |

| Market cap (m) |

$9,720 |

$12,906. (February 22nd 2026) |

| |

|

|

*m=$1,000

|

|

|

IPPE Attendance

|

|

|

The organizers of the 2026 International Production and Processing Expo (IPPE) announced that 29,000 out of the 32,550 registered attended the event. This included 9,706 international participants from 115 countries. Attendees from Latin America accounted for half of international attendees with Canada comprising 15 percent. The organizers of the 2026 International Production and Processing Expo (IPPE) announced that 29,000 out of the 32,550 registered attended the event. This included 9,706 international participants from 115 countries. Attendees from Latin America accounted for half of international attendees with Canada comprising 15 percent.

Show organizers commented, “Despite weather-related challenges, attendance and engagement at the 2026 IPPE remained strong.”

The 2027 IPPE will be held at the Georgia World Conference Center, January 26-28. Additional information is available at <www.ippexpo.org>.

|

|

FSIS to Allow Increased Line Speeds

|

|

In a February 17th announcement, USDA indicated that the rule-making process would be initiated to allow increased line speeds for pork and poultry operating under the Modern Inspection System. Comments are solicited regarding the proposed changes over a 60-day period with information and the deadline available on www.regulations.gov. In a February 17th announcement, USDA indicated that the rule-making process would be initiated to allow increased line speeds for pork and poultry operating under the Modern Inspection System. Comments are solicited regarding the proposed changes over a 60-day period with information and the deadline available on www.regulations.gov.

The National Chicken Council and the Meat Institute support the proposed changes that are based on long-term scientific evaluation in selected pilot plants. Harrison Kircher, president of the National Chicken Council, stated, “The current patchwork approach has created significant uncertainty for companies and has put our members at a disadvantage globally, where other countries operate at faster speeds.” He added, “We appreciate the Administration’s pro-business approach and for helping to increase the global competitiveness of America’s chicken producers.”

Notwithstanding proposed changes considered inevitable, the ultimate responsibility for wholesomeness would rest with the FSIS inspectors who will be authorized to slow or stop operations if safety is compromised. Notwithstanding proposed changes considered inevitable, the ultimate responsibility for wholesomeness would rest with the FSIS inspectors who will be authorized to slow or stop operations if safety is compromised.

It is anticipated that welfare activists and unions will continue to oppose the proposed changes in regulations to allow increased line speeds. Their representations and comments will be taken in context, but it appears that decisions have been made regarding processing efficiency. But the ultimate USDA-FSIS decision will be subject to litigation-perhaps prolonged as the issue works its way through the legal system

|

Paul Hill Honored by NTF

|

|

At the recent annual convention of the National Turkey Federation, Paul Hill was honored with the NTF Lifetime Achievement Award. At the recent annual convention of the National Turkey Federation, Paul Hill was honored with the NTF Lifetime Achievement Award.

Hill began his career in the meat industry in 1947 as a member of a family farm raising turkeys. He earned a degree in agriculture economics from St. Olaf College and undertook mission work in Thailand. Hill has interacted with a number of turkey processors including Bil-Mar Foods, Sara Lee, Land O’Lakes and most recently West Liberty Foods. Hill began his career in the meat industry in 1947 as a member of a family farm raising turkeys. He earned a degree in agriculture economics from St. Olaf College and undertook mission work in Thailand. Hill has interacted with a number of turkey processors including Bil-Mar Foods, Sara Lee, Land O’Lakes and most recently West Liberty Foods.

|

Election of 2026 Officers for USPOULTRY

|

|

The following were elected to executive positions on the Board of Directors of USPOULTRY during the 2026 IPPE: The following were elected to executive positions on the Board of Directors of USPOULTRY during the 2026 IPPE:

• Bill Griffth, Chief Operations Officer for Peco Foods was selected as the Chairman

• Dr. Alice Johnson of Butterball LLC was elected Vice-chair

• Kevin McDaniel of Wayne-Sanderson Farms as named Treasurer

• John Wright of Fieldale Farms was elected Secretary

• Jonathan Cade of Hy-Line International will serve as the Immediate-past Chairman

In commenting on the slate of officers, Nath Morris president of USPOULTRY stated, “With the In commenting on the slate of officers, Nath Morris president of USPOULTRY stated, “With the

experience and guidance these officers bring to our organization, the future of USPOULTRY is in excellent hands and I look forward to their leadership in helping to shape our organization over the next year.”

|

What Constitutes a “Processed Food”

|

|

The recently released Dietary Guidelines for Americans for 2025-2030 discourages consumption of “processed foods”. The emphasis on protein including eggs is a vindication for our industry that has undergone unjustified criticism over cholesterol content in past decades. The recently released Dietary Guidelines for Americans for 2025-2030 discourages consumption of “processed foods”. The emphasis on protein including eggs is a vindication for our industry that has undergone unjustified criticism over cholesterol content in past decades.

The question now arises as to what constitutes “processed foods.” Various definitions have been applied but without consideration of the implications for the manufacturers of packaged  products. Applying the broadest descriptor, “processing” includes any alteration of a food from the natural state through heating, pasteurizing, mixing, milling, freezing or canning. Within reason, these processes are essential to manufacture food products, preserve nutrient quality or to make them available to consumers. With respect to additives, some preservatives have been shown to be both beneficial and innocuous. Many ‘unpronounceable additives’ disfavored by purists are in fact nutrients and contribute to or are essential to health. products. Applying the broadest descriptor, “processing” includes any alteration of a food from the natural state through heating, pasteurizing, mixing, milling, freezing or canning. Within reason, these processes are essential to manufacture food products, preserve nutrient quality or to make them available to consumers. With respect to additives, some preservatives have been shown to be both beneficial and innocuous. Many ‘unpronounceable additives’ disfavored by purists are in fact nutrients and contribute to or are essential to health.

In a move to reject all additives in pursuit of a clean label, activists motivated by either naïve sincerity or outright mendacity risk throwing out the baby with the bath water.

|

Costco Reports on January 2026 Sales

|

|

Costco Wholesale Corporation (COST) is a bellwether on consumer spending and the willingness of customers to purchase food and household items in bulk and splurge on big-ticket items including appliances, electronics and furniture. On February 4th Costco reported sales for January 2026 covering the four-week period ending February 1st. Sales attained $21.33 billion, up 9.3 percent from the value of $18.51 billion during the corresponding month in 2026. Costco Wholesale Corporation (COST) is a bellwether on consumer spending and the willingness of customers to purchase food and household items in bulk and splurge on big-ticket items including appliances, electronics and furniture. On February 4th Costco reported sales for January 2026 covering the four-week period ending February 1st. Sales attained $21.33 billion, up 9.3 percent from the value of $18.51 billion during the corresponding month in 2026.

Same store sales (excluding fuel and foreign exchange) increased 6.8 percent for the U.S.; 8.2 percent for Canada and 2.7 percent for the International warehouse segment. Overall, same-stores sales advanced by 6.4 percent and E-commerce was 33.1 percent higher. International sales were impacted by the advent of the Lunar New Year that was 19 days later than in 2025, beyond the January cut-off. Sales in this segment were depressed by an estimated 4 percent.

Costco advanced in after-hours trading on February 4th after release of the data to $988.50. COST intraday market capitalization was $434.5 billion on February 4th. The share has traded over a 52-week range of $844.06 to $1078.23.

Costco Wholesale Corporation operates 924 warehouses with 634 in the U.S.; 114 in Canada; 42 in Mexico with the remainder in nine other nations.

|

USDA Playing Catchup Over Emergence of NWS

|

|

New World Screwworm (NWS Cochliomyia hominivorax) has seriously disrupted importation of livestock from Mexico to the U.S., directly impacting the cost of beef to consumers. The infestation that emerged in Guatemala and spread to and then within Mexico imposes a threat to livestock producers in the U.S. states bordering our southern neighbor. On recognition of the problem surveillance and control measures were initiated emphasizing the need for cooperation among USMCA regulators.

Decades ago, the problem of NWS was resolved by releasing irradiated sterile male flies that effectively suppressed and then eliminated populations of the parasite. Applying a “mission accomplished” approach without the necessary surveillance by our southern neighbors resulted in an inevitable reoccurrence of infection. To address the current situation, USDA has reactivated irradiation facilities to produce and distribute sterile male flies that will be effective but over time. Decades ago, the problem of NWS was resolved by releasing irradiated sterile male flies that effectively suppressed and then eliminated populations of the parasite. Applying a “mission accomplished” approach without the necessary surveillance by our southern neighbors resulted in an inevitable reoccurrence of infection. To address the current situation, USDA has reactivated irradiation facilities to produce and distribute sterile male flies that will be effective but over time.

The USDA has issued a request for proposals to upgrade surveillance and control measures. Projects, even if funded and implemented will not have any immediate impact on the current emergency. Secretary Rollins is justified in her comment, “We know we have tried-and-true tools and methods that defeat this pest, but we must constantly look for new and better methods and innovate our way to success”.

The lessons that should be heeded include:

- Constant surveillance is necessary for early detection of the parasite

- Irradiation facilities should be maintained with availability of trained personnel to rapidly respond to outbreaks.

- Cooperation with neighboring nations coupled with financial support will ensure that effective surveillance and control measures are maintained. This is difficult to achieve in an atmosphere of hostility generated by U.S. policies relating to tariffs and immigration that detract from mutual understanding and collaboration.

At the end of the day nature ignores national boundaries and has an immense capacity to adapt to changes in the environment. These include socio-economic factors and global warming that facilitate the northward movement of pests and vectors of pathogens affecting human, animal and avian populations.

|

ADM Settles With SEC

|

|

Previously EGG-NEWS reported on restatement of segment earnings by Archer-Daniels Midland Company (ADM) dating back to 2014. Sales and contribution by the Nutrition Segment apparently were misstated by applying creative bookkeeping. When discrepancies were disclosed, the CFO Vikram Luthar was suspended and subsequently resigned. With realization of the implications of the deviation from accepted accounting practice, ADM cooperated with the SEC and implemented “significant remedial measures”. Previously EGG-NEWS reported on restatement of segment earnings by Archer-Daniels Midland Company (ADM) dating back to 2014. Sales and contribution by the Nutrition Segment apparently were misstated by applying creative bookkeeping. When discrepancies were disclosed, the CFO Vikram Luthar was suspended and subsequently resigned. With realization of the implications of the deviation from accepted accounting practice, ADM cooperated with the SEC and implemented “significant remedial measures”.

The SEC alleged that adjustments between the Nutrition segment and other business units of ADM were made including retroactive rebates and use of unrealistic intersegment costs to allow the Nutrition segment to meet targets for fiscal 2021 and 2022. Following extensive investigations by the company, forensic auditors and the U.S. Securities and Exchange Commission (SEC), the Company agreed to a settlement of $40 million but did not admit to any wrongdoing. Concurrently the U.S. Department of Justice has closed its investigation. In addition to Luthar his predecessor Ray G. Young previous CFO and Vince Macciocchi president of the Nutrition Segment and chief Sales and Marketing officer were cited by the SEC.

Juan Luciano Chair of the Board and CEO of ADM noted, “We are pleased to put these matters behind the company. These past couple of years have underscored what is core to ADM -incorporating learnings to future strengthen our business.”

At the end of the day Luciano was ultimately responsible for the irregularities and was aware if not complicit in the financial manipulation. The incident demonstrates the downside of incentive bonuses and Boards dominated by poweful Chairpersons exercising executive action. The incident may well denote a corporate culture inconsistent with shareholder and stakeholder interests and rigid conformity to standard accounting practices and business ethics. As the Brits would say ADM “has form”.

Luthar still faces SEC accusations of violating antifraud provisions of securities legislation and involvement in “abetting ADM’s violation relating to internal accounting control.” Luthar denies the SEC allegations and has not settled as have Macciocchi and Young who paid civil and disgorgement penalties.

In the weeks following the September 2024 disclosures of irregularities, ADM stock fell 30 percent from $72 to $51subsequently closing on January 29, 2026 at $67 compared to a November 2025 high of $98. Over the past 52 weeks, ADM has traded in a range of $41 to $70 with a 50-day moving average of $61. Operating margin is razor thin at 2.0 percent with a profit margin of 1.4 percent. On a 12-month trailing basis, the return on assets is 1.8 percent and 5.2 percent on equity.

|

Establishment of Poultry Industry Food Safety Council

|

|

A collaboration among industry associations representing broilers, eggs, turkeys and ducks has resulted in establishing the Poultry Industry Food Safety Council (PIFSCo) to serve as a central clearinghouse for research and dissemination of data relating to food safety and related issues. A collaboration among industry associations representing broilers, eggs, turkeys and ducks has resulted in establishing the Poultry Industry Food Safety Council (PIFSCo) to serve as a central clearinghouse for research and dissemination of data relating to food safety and related issues.

The Chair of PIFSCo, Kevin Atkins noted, “Food safety is the foundation of consumer trust and the key to the long-term successful industry.” He added, “Through PIFSCo we are bringing together the best science expertise and industry collaboration to rise the standard of food safety from farm to fork.” A new website www.pifsco.org will incorporate:-

- Sharing of best practices for food safety

- Membership and participation information

Kim Rice vice-chairman of PIFSCo stated that “By uniting stakeholders across the poultry industry sectors we will help ensure consistent standards, rapid knowledge-sharing and a stronger foundation for continuous improvement.” Kim Rice vice-chairman of PIFSCo stated that “By uniting stakeholders across the poultry industry sectors we will help ensure consistent standards, rapid knowledge-sharing and a stronger foundation for continuous improvement.”

PIFSCo is supported by the American Egg Board, National Chicken Council, National Turkey Federation, United Egg Producers and USPOULTRY and includes representation by 50 companies and allied industry partners.

|

CEO of Impossible Foods Jumps Ship

|

|

P eter McGuinness has departed from Impossible Foods after a four-year tenure. He has accepted a position as CEO of Bel North America, the U.S. subsidiary of the Bel Group of France a major manufacturer of dairy and vegetable-based snacks and RTE foods. McGuinness will be replaced by a troika comprising Jason Gao, Chief Legal and Operating Officer, Meredith Madden, Chief Demand Officer and Robert Haas, Chief Supply Officer. eter McGuinness has departed from Impossible Foods after a four-year tenure. He has accepted a position as CEO of Bel North America, the U.S. subsidiary of the Bel Group of France a major manufacturer of dairy and vegetable-based snacks and RTE foods. McGuinness will be replaced by a troika comprising Jason Gao, Chief Legal and Operating Officer, Meredith Madden, Chief Demand Officer and Robert Haas, Chief Supply Officer.

Impossible Foods is a private company and does not publish financial data. Given the declining sales and growing losses posted by competitor, Beyond Meat (BYND), it is presumed that Impossible Foods is experiencing similar headwinds including shrinking demand and slim margins. Despite eight infusions of venture capital, Impossible Foods Tape D® price declined from approximately $15 in January 2024 to approximately $2 at the beginning of January 2026.

Ten financing rounds from September 6, 2011, to November 23rd, 2021, raised close to $1.7 billion. Investors include Horizons, Khosla, UVS, Temasek, Viking Global and XN Capital, among others. These companies now have little opportunity to recoup their investments given the limited prospects for the company to launch a successful initial public offering.

Both Impossible Foods and Beyond Meat have experienced declining sales both among retail stores and institutions. Tapering demand is due to noncompetitive cost, inferior organoleptic qualities compared to real meat and poultry, the realization that plant-protein products are ultra- processed. These factors are in addition to reduced concern over livestock welfare, sustainability and the environment and an indifference to industry generated hype. Both Impossible Foods and Beyond Meat have experienced declining sales both among retail stores and institutions. Tapering demand is due to noncompetitive cost, inferior organoleptic qualities compared to real meat and poultry, the realization that plant-protein products are ultra- processed. These factors are in addition to reduced concern over livestock welfare, sustainability and the environment and an indifference to industry generated hype.

|

Immunity to H5N1 Among the Population in British Columbia, Canada

|

|

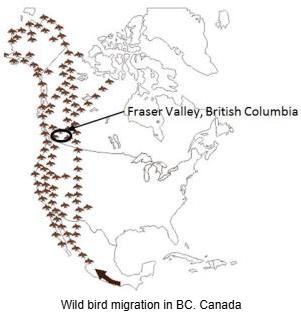

A recent article surveyed immunity to N1 neuraminidase in a population in British Columbia, Canada*. Sera was obtained during August 2024 from 575 participants classified among ten age groups from one to 80 years of age. Neuraminidase inhibition antibody titers were assessed by ELISA assay against H5N1 clade 2.3.4.4b. In assessing N1 titers, 70 percent had detectable antibodies with half of the total yielding a low to moderate value, 32 percent at an intermediate threshold and 17 percent with a high concentration of antibody. The level of antibody was consistent with previous exposure to H1N1 influenza pandemics in cohorts born from 1997 to 2003, many children exposed during the 2009 H1N1 outbreak and among those born before 1947.

The authors concluded that “a substantial proportion of the population has pre-existing anti-N1 against H5N1 with age-related variation”.

It is difficult to reconcile the low rate of infection attributed to H5N1 among workers with intensive exposure during depopulation and decontamination of infected poultry farms. A comprehensive epidemiologic survey of dairy and poultry workers has yet to be published.

It is generally conceded that workers at risk of exposure to H5N1 should be vaccinated against the prevailing seasonal influenza quadrivalent product to minimize the risk, albeit slight, of a recombinant event. It is also suggested that dairy and poultry farm and processing workers should be vaccinated using an available H5N1 vaccine as deployed in Scandinavia for poultry and fur-farm workers.

*Skowronski, D. M., Cross-Reactive H5N1 Neuraminidase Antibodies by Agent Influenza Imprinting Cohorts of the Past Century: Population-Based Sero Survey, British Columbia, Canada J. Infectious Diseases. doi.org/10.1093/infdis/jiag 030 (2026)

|

Cultivated Meat Funding Implodes

|

|

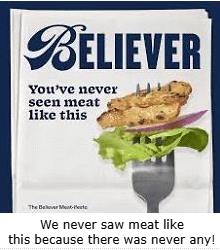

According to Ag Funder, financial support for cultivated meat enterprises has tanked. Data confirms a reduction from close to $1 billion in 2021 to investment of only $65 million in 2024. Evaporation of venture capital financing and rejection of funding rounds for existing companies has resulted in termination of operations. Meatable in the Netherlands, considered the most capable of  bringing forward a marketable product ceased operation in late 2025 concurrently with Believer Meats in the U.S. Industry observers ascribe the trend to the failure of startups to justify predictions of both consumer demand and their ability to produce. Hype only goes so far. bringing forward a marketable product ceased operation in late 2025 concurrently with Believer Meats in the U.S. Industry observers ascribe the trend to the failure of startups to justify predictions of both consumer demand and their ability to produce. Hype only goes so far.

In the case of Believer Meats, the company embarked on major capital investment in buildings and installations without demonstrating their capacity to expand from pilot-scale production to commercial-level output using bioreactors that would be consistent with even miniscule demand. Spokespersons for failed companies claim regulatory restraints but in both Western Europe and the U.S. there were few obstacles imposed by governments. In contrast, many states in the U.S. and nations in Europe including France and Italy have enacted legislation banning either the production or sale of cultivated meat or have imposed rigorous labeling requirements as demanded by livestock producers.

Even if technical restraints had been overcome, it is doubtful whether demand for cultivated meat would have justified investment in facilities given concern over ultra-processed foods, a narrow range of products and non-competitive cost against “real” meat. Experience of the plant-based substitute-meat industry should have served as a warning to both venture capital companies and over enthusiastic proponents of cultivated meat based on sustainability and welfare. These attributes have paled in significance during the past five years with cost and availability considerations that have become dominant in a post-COVID food market. Even if technical restraints had been overcome, it is doubtful whether demand for cultivated meat would have justified investment in facilities given concern over ultra-processed foods, a narrow range of products and non-competitive cost against “real” meat. Experience of the plant-based substitute-meat industry should have served as a warning to both venture capital companies and over enthusiastic proponents of cultivated meat based on sustainability and welfare. These attributes have paled in significance during the past five years with cost and availability considerations that have become dominant in a post-COVID food market.

|

|

Shane Commentary

|

|

|

|

|