Editorial

|

Balance Between Pre-election Rhetoric and Outcomes

or You Can’t Have It Both Ways!

|

|

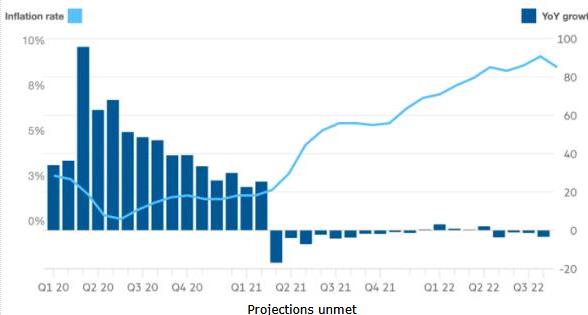

It is evident that the incoming Administration of President Donald J. Trump will attempt to implement many of the pre-election promises early during the coming term of office. The principal policies will revolve around deportation of illegal immigrants and improving the financial wellbeing of citizens. These objectives will establish conflicts that have a direct bearing on agriculture and hence the availability and price of food. Apparent conflicts will have to be resolved by concessions made by both sides of the aisle in the 119th Congress. Legislators holding extreme positions on the left and right will be forced to moderate their entrenched positions in the interests of the nation. It is evident that the incoming Administration of President Donald J. Trump will attempt to implement many of the pre-election promises early during the coming term of office. The principal policies will revolve around deportation of illegal immigrants and improving the financial wellbeing of citizens. These objectives will establish conflicts that have a direct bearing on agriculture and hence the availability and price of food. Apparent conflicts will have to be resolved by concessions made by both sides of the aisle in the 119th Congress. Legislators holding extreme positions on the left and right will be forced to moderate their entrenched positions in the interests of the nation.

Potential conflict areas include:

- Tariffs raise the prospects of trade wars. If the Administration imposes tariffs on our two USMCA partners, in addition to the E.U. and especially China, trade will be impacted by countervailing punitive action. This will reduce exports and disturb the equilibrium between domestic supply and demand. Prices for major agricultural commodities including corn and soybeans will fall to the advantage of livestock producers but will seriously reduce the earnings of row-crop farmers.

- Deportation of nondocumented agricultural workers will reduce the availability of labor and increase the cost of production. This will be passed onto consumers and will run counter to the promise to reduce family expenditure on food.

- Relaxation of environmental, health, financial and other regulations will facilitate expansion of some agricultural operations. Advantages may however be offset by fraud, a decline in food safety standards and environmental degradation.

- Reversal of climate remediation will be counterproductive. Progress has been made in reducing greenhouse gas emissions by adopting solar and wind generation of electrical power displacing fossil fuels. Encouraging greater use of petroleum products through a “drill-baby-drill” approach may be both impractical and ultimately costly. Global warming is contributing to the frequency and intensity of hurricanes and other weather extremes imposing high costs for response and repair of damage. Reversing progress in clean energy through restricting wind, solar and nuclear generation would be to the medium- and long-term detriment of our economy and health in the U.S.

- Reducing government expenditure by as much as $2 trillion annually would require extensive reductions in social security and Medicaid benefits. Although preventive medicine will ultimately reduce the cost of treatment of chronic conditions, benefits would only accrue in future decades, but the pain would be borne in the immediate term.

- Increasing farm support would appear necessary following a trade war characterised by reduced exports, increased costs for labor and the inevitable restoration of inflation predicated by a program of tariffs. This would require an increase in the national debt that is antithetical to conservative values.

Radical solutions to current problems will have unintended consequences. The move towards isolation as exemplified by the Smoot-Hawley Tariff Act of 1930 effectively precipitated the great depression over the third decade of the previous century. Farmers were the most impacted segment of the economy resulting in profound demographic changes in our population. Despite improved efficiency in the agricultural sector through consolidation and mechanization, both cost and revenue will be adversely affected by inappropriate and imprudent policy decisions.

It is hoped that bipartisanship and sound economic policies will prevail in the coming administration and 119th Congress and that extreme pre-electoral rhetoric and promises will be modulated in the interests of wellbeing of our citizenry and long-term growth of the economy.

|

|

Poultry Industry News

|

To our subscribers

|

|

Regular editions of EGG-NEWS and CHICK-NEWS will suspend publication at the beginning of 2025. This reality after twelve years of operation is a personal decision to create opportunities for new challenges.

It is hoped that the commentaries, news, editorials and statistical reviews have educated subscribers and readers and stimulated thought and discussion. If the interests of the industry and the wellbeing of their companies and operations have been advanced then the enterprise and efforts have been worthwhile.

Gratitude is extended to sponsors who have made the newsletters possible and provided encouragement over the years. They are all worthy of continued support through their equipment, products and services.

In coming months EGG-NEWS and CHICK-NEWS will circulate focus editions based on innovative products and technology in written and alternative formats to continue the tradition of independent reporting, commentary and advocacy.

|

Broiler Month

|

|

Monthly Broiler Production and Prices, December 2024.

Broiler Chick Placements.

According to the December 18th 2024 USDA Broiler Hatchery Report, 990.42 million eggs were set over four weeks extending from November 23rd 2024 through December 14th 2024 inclusive. This was three percent higher compared to the corresponding period in 2023.

Total chick placements for the U.S. over the five-week period amounted to 764.16 million chicks. Claimed hatchability for the period averaged 79.7 percent for eggs set three weeks earlier, unchanged from the preceding five-week period. Each 1.0 percent change in hatchability represents approximately 1.91 million chicks placed per week and 1.82 million broilers processed, assuming five percent culls and mortality and with the current range of weekly settings.

Cumulative chick placements for the period January 7th through December 30th 2023 amounted to 9.67 billion chicks. For January 6th through December 14th 2024 chick placements attained 9.46 billion, up two percent from the corresponding week in 2023.

According to the December 20th 2024 edition of the USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during November 2024 amounted to 8.26 million, up 0.7 percent (56,000 pullet chicks) from November 2023 and 2.5 percent (205,000 pullet chicks) more than the previous month of October 2024. Broiler breeder hen complement attained 60.88 million on November 1st 2024, 2.7 percent (1.74 million hens) less than on November 1st 2023.

Broiler Production

As documented in the December 20th 2024 USDA Broiler Market News Reports for the processing week ending December14th 2024, 166.6 million broilers were processed at 6.53 lbs. live. This was 1.9 percent less than the 169.9 million broilers processed during the corresponding week in the previous month of November 2024 and 0.6 percent less than the 167.6 million processed during the corresponding week in December 2023. Broilers processed in 2024 to date amounted to 8,200 million, 1.3 percent lower than for the corresponding period in 2023.

Ready to cook (RTC) weight for the most recent week in December was 830.8 million lbs. (377,639 metric tons). This was 1.8 percent less than the 845.9 million lbs. processed during the corresponding week in November 2024 and 0.8 percent more than the 824.1 million lbs. during the corresponding week in December 2023. Dressing percentage was a nominal 76.0 percent. For 2024 to date RTC broiler production attained 40,607 million lbs. (18.46 million metric tons). This quantity was 0.6 percent more than for the corresponding period in 2023.

Broiler Prices

The USDA National Composite Weighted Wholesale price for the week ending December 20th 2024 was up 4.6 cents per lb. to 132.6 cents per lb. from the corresponding week in November 2024. The attached USDA figures denote average prices over three-years.

Leading QSRs are using increasing quantities of breast meat for sandwiches, strips and nuggets. Inflation is increasing consumer awareness of value with chicken benefitting at the expense of beef and pork

|

Turkey Month

|

|

Monthly Turkey Production and Prices, December 27th 2024

Poult Production and Placement:

The December 13th 2024 edition of the USDA Turkey Hatchery Report, issued monthly, documented 24.66 million eggs in incubators on December 1st 2024 compared to 25.35 million eggs on December 1st 2023* The December 2024 set was down 0.68 million eggs (2.7 percent) from December 2023 and 0.19 million eggs (0.8 percent) from than the previous month of November 2024.

A total of 21.02 million poults were hatched during November 2024 down 0.65 million poults (3.0 percent) compared to 21.67 million in November 2023*. The November 2024 hatch was almost unchanged (down 4,000 poults) from the previous month of October.

A total of 19.27 million poults were placed on farms in the U.S. in November 2024, compared to 19.94 million in November 2023*. The November 2024 placement was 0.67 million poults (3.4 percent) less than in October 2023. The November placement was 0.11 million higher than the previous month of October. This data confirms disposal of 1.75 million poults during the month. Approximately 8.3 percent of the November 2024 hatch was not placed.

For the twelve-month period December 2023 through November 2024 inclusive, 252.03 million poults were hatched and 235.42 million were placed. This confirms disposal of 16.61 million poults over the 12-month period, corresponding to 6.6 percent of all poults hatched.

* USDA revision from previous monthly report.

Turkey Production:

The December 20th 2024 edition of the Turkey Market News Reports documented the following provisional data for turkeys slaughtered under Federal inspection:-

- For the processing week ending December 14th 2024, 1.393 million hens were processed at 17.7 lbs. live. This was 37.9 percent less than the 2.242 million hens processed during the corresponding week in November 2024 and 21.1 percent more than the 1.765 million processed during the corresponding week in December 2023. Hen slaughter year-to-date has attained 81.1 million, 11.3 percent less than for the corresponding period in 2023.

- Ready to cook (RTC) weight for hens over the most recent week was 19.83 million lbs. (9,012 metric tons). This quantity was 29.8 percent less than the 28.25 million lbs. for corresponding week in November 2024 and 9.7 percent less than the 21.97 million lbs. during the corresponding week in December 2023. Dressing percentage was a nominal 80.5 percent. For 2024 to date RTC hen production attained 1,111 million lbs. (504,836 metric tons). This quantity is 11.1 percent less than for the corresponding period in 2023.

- For the processing week ending December 14th 2024, 1.974 million toms were processed at 43.4 lbs. live. This was 4.6 percent less than the 2.070 million toms processed during the corresponding week in November 2024 and 8.1 percent less than the 2.148 million during the corresponding week in December 2023. Year-to-date 99.75 million toms have been processed, 0.9 percent less than for the corresponding period in 2023.

- Ready to cook (RTC) weight for toms during the most recent week was 69.0 million lbs. (31,356 metric tons). This quantity was 0.5 percent less than the 72.7 million lbs. processed during the corresponding week in November 2024 and 9.5 percent less than the 76.2 million lbs. during the corresponding week in December 2023. Dressing percentage was a nominal 80.5 percent. For 2024 to date RTC tom production attained 3,559 million lbs. (1.618 million metric tons). This quantity is less than 0.1 percent more than the corresponding period in 2023.

Wholesale Prices

The National average frozen hen price (8 to 16 lbs.) for conventional birds during the week ending December 20th was 104.0 cents per lb., 7.7 cents per lb. above than the previous month in 2024 and down 20 cents per lb. from the three-year average of approximately 124 cents per lb. The following prices rounded to the nearest cent were documented in the new format report for domestic and export trading for December 2024 as reported on December 20th:-

|

Product

|

cents per lb.

|

Change from previous Month (%)

|

|

Frozen hens whole Grade A (8-16 lb)

|

104

|

+8.3

|

|

Frozen toms whole Grade A (16-24 lb)

|

105

|

+11.7

|

|

Thighs (bone in)

|

Not listed

|

-

|

|

Necks (toms, export)

|

104

|

+7.7

|

|

Breasts 4-8 lb. (fresh)

|

Not listed

|

-35.8

|

|

Breasts B/S (toms, fresh)

|

165

|

-

|

|

Drums (toms)

|

114

|

+4.6

|

|

Wings (full-cut tom)

|

112

|

+4.7

|

|

Tenderloins

|

218

|

+67.6

|

|

Thigh Meat (skin and boneless)

|

191

|

+3.2

|

|

Mechanically Separated (domestic)

(export)

|

52

Not listed

|

+8.3

-

|

|

Meat Projection Dec 2024

|

|

Updated USDA-ERS Poultry Meat Projection for December 2024. Updated USDA-ERS Poultry Meat Projection for December 2024.

On December 16th 2024 the USDA-Economic Research Service released updated production and consumption data with respect to broilers and turkeys, covering 2023 an update of 2024 and a forecast for 2025.

The 2024 projection for broiler production is 47,187 million lbs. (21.449 million metric tons) up 1.7 percent from 2023. USDA projected per capita consumption of 102.3 lbs. (46.5 kg.) for 2024, up 2.8 percent from 2023. Exports will attain 6,742 million lbs. (3.065 million metric tons), 7.5 percent below the previous year.

The 2025 USDA forecast for broiler production will be 47,925 million lbs. (21.7984 million metric tons) up 1.6 percent from 2024 with per capita consumption up 1.0 lb. to 103.3 lbs. (47.0 kg). Exports will be 0.8 percent higher compared to 2024 at 6,795 million lbs. (3.089 million metric tons), equivalent to 14.2 percent of production.

Production values for the broiler and turkey segments of the U.S. poultry meat industry are tabulated below:-

|

Parameter

|

2023

(actual)

|

2024

(projection)

|

2025

(forecast)

|

Difference

2024 to 2025

|

|

Broilers

|

|

|

|

|

|

Production (million lbs.)

|

46,387

|

47,187

|

47,925

|

+1.6

|

|

Consumption (lbs. per capita)

|

99.5

|

102.3

|

103.3

|

+1.0

|

|

Exports (million lbs.)

|

7,260

|

6,742

|

6,795

|

+0.8

|

|

Proportion of production (%)

|

15.7

|

14.3

|

14.2

|

-0.7

|

|

|

|

|

|

|

|

Turkeys

|

|

|

|

|

|

Production (million lbs.)

|

5,457

|

5,147

|

5,145

|

< -0.1

|

|

Consumption (lbs. per capita)

|

14.8

|

14.0

|

13.7

|

-2.1

|

|

Exports (million lbs.)

|

490

|

502

|

530

|

+2.9

|

|

Proportion of production (%)

|

9.0

|

9.8

|

9.7

|

-1.0

|

Source: Livestock, Dairy and Poultry Outlook released December 16th 2024

The December USDA report updated projection for the turkey industry for 2024 including annual production of 5,147 million lbs. (2.340 million metric tons), down 3.7 percent from 2023. Consumption in 2024 is projected to be 14.0 lbs. (6.4 kg.) per capita, down 5.7 percent from the previous year. Export volume will increase by 2.5 percent in 2024 to 502 million lbs. (228,000 metric tons). Values for production and consumption of RTC turkey in 2024 are considered to be realistic, given year to date data, the prevailing economy, variable weekly poult placements, production levels, limited losses from HPAI and inventories consistent with season.

The 2025 forecast for turkey production is 5,145 million lbs. (2.339 million metric tons) down 0.1 percent from 2024 with per capita consumption down 2.1 percent to 13.7 lbs. (6.2 kg). Exports will be 5.6 percent higher than in 2024 to 530 million lbs. (240,910 metric tons) equivalent to 9.7 percent of production. The 2025 forecast for turkey production is 5,145 million lbs. (2.339 million metric tons) down 0.1 percent from 2024 with per capita consumption down 2.1 percent to 13.7 lbs. (6.2 kg). Exports will be 5.6 percent higher than in 2024 to 530 million lbs. (240,910 metric tons) equivalent to 9.7 percent of production.

Export projections do not allow for a breakdown in trade relations with existing major partners including Mexico, Canada and China nor the impact of catastrophic diseases including HPAI and vvND in either the U.S. or importing nations

Compared to 2023 exports of broiler products to China during 2024 were 34 percent lower in volume to 405,343 metric tons and 34 percent lower in value to $711 million. For the first half of 2024 broiler volume to 4th-ranked China was down 62 percent from the corresponding months in 2023 to 92,069 metric tons. Value was down 54 percent to $183 million.

|

Adoption of Better Chicken Commitment Will Increase Cost

|

|

Animal activists, opposed to all forms of intensive livestock production, consistently base their demands on welfare notwithstanding their actual indifference to poultry and animals. A principal tactic by activist organizations is to coerce retailers into demanding adherence to successively more rigorous “standards” of welfare. At the heart of the initiative in the U.K. is the Better Chicken Commitment that is claimed to provide marketing advantages to retailers based on consumer sentiment.

Effectively, the motivators to purchase chicken are quality, taste and price with preference ratings above 75 percent compared to welfare and sustainability that rank below 25 percent in consumer preference studies. Effectively, the motivators to purchase chicken are quality, taste and price with preference ratings above 75 percent compared to welfare and sustainability that rank below 25 percent in consumer preference studies.

Economists have reviewed the financial impact of the standards required for the Better Chicken Commitment. Reducing stocking density in the U.S. would require considerably more growing area to maintain current production if the highest level of housing including outside access is applied to the current 165 million broilers per week.

The live bird performance achieved by integrators across the entire industry denotes acceptable welfare and housing as denoted by high livability and growth rate that approach genetic potential.

The downside of adopting global animal partnership standards include: -

- Predator loss for flocks allowed outside access.

- Higher mortality from exposure to soil-related pathogens.

- Higher production cost from inferior growth rate and a deterioration in feed conversion efficiency

Sustainability will be adversely impacted by lower stocking density and adopting free-range or pastured systems. The additional broiler placements to compensate for lower output and a higher number of birds would require more feed that in turn has implications for energy and water consumption and generation of waste through the entire cycle of production.

On a restricted brand basis the higher cost can be passed on to a small market of affluent consumers. Subscribers will be aware of the failure of producers of other than conventional broilers with welfare claims requiring outside access and liberal stocking density.

|

WH Group to Actively Pursue U.S. IPO

|

|

Shareholders of the WH Group, registered in Hong Kong, have approved a proposal to offer 20 percent of Smithfield Food equity in an initial public offering by a vote of 99 percent. The magnitude for acceptance of the resolution is not unrealistic given the disproportionate control exercised by founder and CEO Wan Long.

Smithfield Foods was acquired for $4.7 billion in 2013 by Shuanghui, the predecessor of the WH Group. The holding company values Smithfield assets at $5.4 billion with the intended IPO netting the company approximately $1 billion depending on share price and uptake.

|

|

|

|

USPOULTRY Market Intelligence Forum

|

|

The 2025 Poultry Market Intelligence Forum will be presented at the International Production and Processing Expo. (IPPE) from 09H00 to noon on Wednesday January 29, 2025. The 2025 Poultry Market Intelligence Forum will be presented at the International Production and Processing Expo. (IPPE) from 09H00 to noon on Wednesday January 29, 2025.

The program will feature economists who will highlight problems and opportunities facing the poultry industry. Speakers will include:

- Christian Richter of The Policy Group delivering the Washington Update for 2025.

- Mark Jordan of Leap Market Analytics will discuss the current economy and future trends.

- Wendy Reinhardt Kapsak of the International Foods Information Council will discuss the supply chain, consumerism and related issues.

The Forum is available to all IPPE registrants at no charge.

|

Registration Now Open for PEAK

|

|

The Midwest Poultry Federation has opened registration for the 2025 PEAK Convention The Midwest Poultry Federation has opened registration for the 2025 PEAK Convention

The 2025 PEAK event will be held at the Minneapolis Convention Center April 8th – 10th. In addition to the trade show and educational program, the Multi-State Poultry Feeding and Health Conference will take place on April 8th and the PEAK Unhatched event will be presented on the evening of April 8th.

Lisa Henning, president of the Midwest Poultry Federation noted, “PEAK 2025 is the ultimate destination for the poultry industry.” She added, “With our expanded Education Theater offering 30 presentations and the trade show floor, PEAK is where connections are made, common knowledge is shared, and solutions are found.”

Concurrent programs at PEAK include the Organic Farmers of America Symposium, the Devenish Nutrition Symposium and the North Central Avian Disease Conference.

For further information access info@midwestpoultry.com or (763) 284-6763

|

|

|

Integrators Settle over Alleged Labor Rate Conspiracy

|

|

An additional nine broiler or turkey integrators have settled for a total of $180 million arising from claims of conspiracy to set wage rates. Defendants with their payments included the following companies with the agreed quantum in descending order in parentheses:- An additional nine broiler or turkey integrators have settled for a total of $180 million arising from claims of conspiracy to set wage rates. Defendants with their payments included the following companies with the agreed quantum in descending order in parentheses:-

Tyson Foods and Keystone Foods (combining $115.5 million); Koch Foods ($18.5 million), Foster Poultry Farms ($13.3 million), Butterball ($8.5 million), Amick Farms ($6.3 million), Fieldale Farms ($5.5 million), Allen Harim ($5.0 million), O.K. Foods ($4.8 million), Jennie-O Turkey Store ($3.5 million).

Plaintiffs claimed that both direct collusion occurred among defendants at industry meetings in addition to direct contacts that compared rates and established “no poach” agreements. A significant component of the lawsuit was the availability of wage rates received as subscribers to AgriStats® a proprietary benchmark price discovery service.

Total settlements to date have exceeded $400 million. This makes Agristats® an expensive subscription not to mention the annual meetings on the Gulf Coast.

Courts have yet to try the case against Agristats® and possibly consider the liability of Elanco Animal Health, owner of the company during part of the period when the alleged collusion occurred.

|

Boar’s Head Response to Representative DeLauro “Inadequate”

|

|

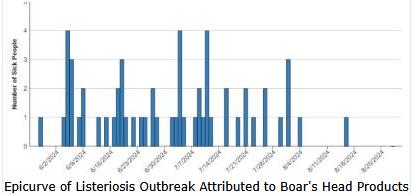

Following the recall of seven million pounds of ready-to-eat deli meat by Boar’s Head Provisions Inc. arising from an extensive outbreak of listeriosis, Representative Rosa DeLauro (D-CT) addressed a letter to the company requesting specific information on current and intended action to reduce contamination. The response through the law firm Hogan Lovells was less than satisfactory resulting in an expression of disapproval and characterized as a “corporate dodge”. Following the recall of seven million pounds of ready-to-eat deli meat by Boar’s Head Provisions Inc. arising from an extensive outbreak of listeriosis, Representative Rosa DeLauro (D-CT) addressed a letter to the company requesting specific information on current and intended action to reduce contamination. The response through the law firm Hogan Lovells was less than satisfactory resulting in an expression of disapproval and characterized as a “corporate dodge”.

Representative DeLauro, who is experienced in food safety and epidemiology, requested specific information on how the company will comply with food safety standards in the future. The company, through its legal representative, failed to respond to questions on past food safety programs and the egregious deficiencies identified by food inspectors of the state of Virginia and USDA Food Safety Inspection Services. There was no response as to accountability among management of the Jarratt, VA. plant or the corporate staff responsible for food safety. Representative DeLauro, who is experienced in food safety and epidemiology, requested specific information on how the company will comply with food safety standards in the future. The company, through its legal representative, failed to respond to questions on past food safety programs and the egregious deficiencies identified by food inspectors of the state of Virginia and USDA Food Safety Inspection Services. There was no response as to accountability among management of the Jarratt, VA. plant or the corporate staff responsible for food safety.

USDA documented numerous instances of noncompliance following inspection of the Jarratt plant between August 2023 and 2024. USDA recorded an extensive history of violations during 2022 in the Virginia plant that has since has been closed.

In a classic example of shutting the stable door after the horse has bolted, Boars Head appointed a Food Safety Council and launched a self-serving website in an attempt to restore consumer confidence. Boar’s Head recently settled with the estate of one of the ten fatalities, with the prospect of additional lawsuits from among the 60 or more victims of listeriosis traced back to the Jarratt VA, plant.

|

British Researcher Criticizes Cell-Cultured Meat

|

|

Dr. Marco Springmann, an advocate for plant-based foods serves as a Senior Researcher at the University of Oxford Environmental Change Institute. He recently concluded a study on the environmental impact of various foods including red meat, milk, legume-based alternatives to meat. With respect to cell-cultured product he commented “For years this approach has been hailed as a dietary magic bullet which would retain all the pleasure of meat without the ethical environmental drawbacks.” Dr. Springman maintains that the entire concept of cell-cultured meat is a “costly fantasy”. He notes that technologies are unproven and that even with scale-of-production, and even if it has equivalent organoleptic qualities to conventional beef, pork and chicken, will not be competitive on price. He maintains that, “Rather than throwing more money at developing novel processed food products, it would be more beneficial to think about strategies to integrate unprocessed foods into diets”. This will require a meal perspective instead of concentrating on individual food items. Dr. Marco Springmann, an advocate for plant-based foods serves as a Senior Researcher at the University of Oxford Environmental Change Institute. He recently concluded a study on the environmental impact of various foods including red meat, milk, legume-based alternatives to meat. With respect to cell-cultured product he commented “For years this approach has been hailed as a dietary magic bullet which would retain all the pleasure of meat without the ethical environmental drawbacks.” Dr. Springman maintains that the entire concept of cell-cultured meat is a “costly fantasy”. He notes that technologies are unproven and that even with scale-of-production, and even if it has equivalent organoleptic qualities to conventional beef, pork and chicken, will not be competitive on price. He maintains that, “Rather than throwing more money at developing novel processed food products, it would be more beneficial to think about strategies to integrate unprocessed foods into diets”. This will require a meal perspective instead of concentrating on individual food items.

Dr. Springmann is evidently a vegetarian, converted to eating plant-based diets as a graduate student in the U.S. His dietary preferences were based on a fear of cardiovascular disease and developing cancer. He has advocated taxes on red meat and his studies suggest that western nations need to reduce consumption of red meat by 90 percent to have any effect on climate change.

He is less than complimentary over highly processed plant-based alternatives to conventional meat. He states, “Rather than replacing a burger with another burger, he suggests that meals should be prepared from legumes such as a bean chili or stir fry with tempeh.” He is an advocate of alternatives to milk, based on their low environmental impact. He acknowledges that substitutes such as almond milk provide only a quarter of the calories of cow’s milk but generate only 30 percent of the greenhouse gas emission of fluid milk.

Although a proponent of consuming plant-based meals, his approach is essentially analytical, considering the quantifiable inputs and environmental effects of supplying protein from plant and animal sources.

|

Tyson Revamps Packaging

|

|

Tyson Foods has embarked on a major redesign of packaging after a span of 15 years. The initiative is based on market research with a favorable response to changes. The program will embrace Tyson Foods brands including Hillshire Farms and Jimmy Dean and will focus on a more contemporary appearance with informative messaging emphasizing product quality and nutritional content. Tyson Foods has embarked on a major redesign of packaging after a span of 15 years. The initiative is based on market research with a favorable response to changes. The program will embrace Tyson Foods brands including Hillshire Farms and Jimmy Dean and will focus on a more contemporary appearance with informative messaging emphasizing product quality and nutritional content.

Tyson Foods will combine the rollout of packaging with an advertising campaign with the theme “Always Been Tyson”. The program will involve a phased introduction to avoid write-off of existing material and will extend over the fourth quarter of 2024 into 2025. Fully cooked frozen chicken was initially presented in the new packaging in September. Tyson Foods will follow with refrigerated and fresh products to eventually include all products within the Tyson brand.

|

Major Listeria Recall

|

|

Alexander and Hornung, a subsidiary of Perdue Premium Meat Company is recalling close to 1,100 tons of fully cooked ham and pepperoni products according to an FSIS release, since there is a potential for contamination with Listeria monocytogenes. Products carry the establishment number M10125. Originally the recall involved 100 tons but was expanded in all probability due to the inability of the processor to identify specific production lots. Alexander and Hornung, a subsidiary of Perdue Premium Meat Company is recalling close to 1,100 tons of fully cooked ham and pepperoni products according to an FSIS release, since there is a potential for contamination with Listeria monocytogenes. Products carry the establishment number M10125. Originally the recall involved 100 tons but was expanded in all probability due to the inability of the processor to identify specific production lots.

The cost of Listeria contamination across meat processing has attained unprecedented levels in 2024 with this incident, and those attributed to Boar’s Head and Yu Shang as the notable protein-related foodborne Listeria outbreaks. The cost of Listeria contamination across meat processing has attained unprecedented levels in 2024 with this incident, and those attributed to Boar’s Head and Yu Shang as the notable protein-related foodborne Listeria outbreaks.

|

FSIS Clamps Down on Listeria

|

|

Stung by criticism over recent outbreaks of listeriosis with the Boar’s Head episode as an outstanding example, the USDA Food Safety and Inspection Service (FSIS) has introduced an initiative to reduce foodborne infection due to Listeria.

The multiphase program will include testing for the genus Listeria in addition to a previous concentration on L. monocytogenes, the principal pathogenic species. This approach is based on the fact that if any Listeria is isolated from equipment or the environment of a plant producing ready-to-eat items, deficiencies in structure or operations exist, predisposing to infection.

The FSIS will work closely with the National Advisory Committee on Microbial Criteria for Foods for guidance on procedures and regulations. In 2025 FSIS will intensify assessment of plants and facilities with an emphasis on sanitation. Plants identified as a risk will be subject to repeat visits with the participation of senior inspectors and supervisors.

Instruction and training for food safety inspectors will be intensified. A mandatory training review course on ready-to-eat foods has been issued and will require study and examination to ensure competency by mid-February 2025.

|

Plant-Based Meat Sales Fall in November

|

|

Circana, a market research company, announced that sales of plant-based alternatives to meat attained $72.3 million at retail in November. This was a decrease of 4.7 percent compared to the corresponding month in 2023. Unit sales were down 7.6 percent.

To place plant-based alternatives in perspective, the average monthly revenue for the category in 2023 was $4.5 million. The average total for broilers, turkeys and red meat was $19 billion per month. Based on the monthly figures assembled by Circana, plant-based meat sales represent approximately 0.3 percent of red meat and poultry combined and with a downward trend. To the private and corporate investors in plant based and cell-cultured alternatives to real meat the lesson from the trend in sales is clearly caveat donor.

|

Adverse Verdict Against Pilgrim’s Pride over Boneless Chicken

|

|

Innovative Solutions International, a processor of chicken supplied Trader Joe’s with burgers produced from allegedly boneless chicken supplied by Pilgrim’s Pride. Customer complaints of bone fragments in the burgers led to Trader Joe’s cancelling a supply agreement with Innovative Solutions resulting in a November recall and eventual cancelation of future purchases by Trader Joe’s. Innovative Solutions sued Pilgrim’s Pride resulting in a verdict against the integrator with the court awarding $10 million in damages.

The lawsuit filed in 2020 alleged breach of contract, breach of warranty, negligent misrepresentation and violation of the Washington State Consumer Protection Act.

|

Dean Sausage Company Subject to OSHA Fines

|

|

Dean Sausage Company (not related to Jimmy Dean, a brand of Tyson Foods) located in Attalla, AL. has been fined $103,000 following an OSHA inspection. Investigators for the Agency cited the company for safety violations that exposed workers to hazards including electric shock, burns and hazardous chemicals. Dean Sausage Company (not related to Jimmy Dean, a brand of Tyson Foods) located in Attalla, AL. has been fined $103,000 following an OSHA inspection. Investigators for the Agency cited the company for safety violations that exposed workers to hazards including electric shock, burns and hazardous chemicals.

Penalties were imposed after inspections in 2022 and 2023 for similar violations. During the spring of 2024 the company was fined $116,000 for seven repeat violations from the previous 2022 inspections. The most recent July evaluation determined that many ‘other-than-serious’ violations had not been corrected including failure to train employees or to document hazards relating to chemicals.

Surely the OSHA has the power to reduce danger to workers in plants adjudged to be serial violators. How bad does it have to become before serious injuries occur. Why does OSHA or a delegated state agency not have the power to close plants adjudged to be hazardous to workers? Who is minding the store?

|

USDA to Invest in Screwworm Control

|

|

USDA has announced an initiative funded by $165 million from the Commodity Credit Corporation to suppress New World Screwworm (Cochliomyia hominivorax) in Central America and to prevent introduction into the U.S. After the infestation was identified in Mexico, USDA placed an embargo on importation of cattle across the southern border. This has led to disruption in live animal trade and has the potential to increase beef prices for consumers. USDA has announced an initiative funded by $165 million from the Commodity Credit Corporation to suppress New World Screwworm (Cochliomyia hominivorax) in Central America and to prevent introduction into the U.S. After the infestation was identified in Mexico, USDA placed an embargo on importation of cattle across the southern border. This has led to disruption in live animal trade and has the potential to increase beef prices for consumers.

It is anticipated that importation will resume in early 2025, but this will depend on ongoing cooperation between veterinary authorities in the U.S. and Mexico. It is envisioned that holding pens will be established at import points along the southern border that will allow inspectors to determine that cattle are free of lesions.

Funds will be made available from the Emergency Allocation to propagate sterile male screwworm flies that will be released in Central America. Depending on the proportion of sterile males that mate with females, egg deposition on host animals will be markedly reduced, and populations of adult flies should drop. From 1966 onwards the USDA effectively eliminated New World screwworm from north of the Panama Canal through a program of surveillance and release of sterile males.

Dr. Rosemarie Sifford, Chief Veterinary Officer of the USDA, stated, “While the United States will work very closely with Mexico and has agreed to protocols, it will take some time to implement these due to multiple steps needed to resume trade.”

|

Hormel Posts Results for Q4 and FY 2024

|

|

In a release dated December 4th Hormel Foods (HRL) reported on Q4 and FY 2024 ending October 27th, disappointing on the top line, reporting lower revenue and adjusting guidance only slightly for FY 2025. In a release dated December 4th Hormel Foods (HRL) reported on Q4 and FY 2024 ending October 27th, disappointing on the top line, reporting lower revenue and adjusting guidance only slightly for FY 2025.

For the quarter the company earned a reported (GAAP) $220.2 million on revenue of $3,138 million with a diluted EPS of $0.40. Comparable values for Q4 FY 2023 ending October 29th were net income of $195.9 million on revenue of $3,198 million with a diluted EPS of $0.36.

Compared to Q4 of FY 2023 sales declined by 1.9 percent, gross margin increased from 16.1 percent to 16.6 percent and operating margin was up from 5.3 percent to 5.8 percent for the most recent quarter. Profit margin was unchanged at 7.0 percent for both quarters.

For the FY 2024 the company earned a reported (GAAP) $805.5 million on revenue of $11,921 million with a diluted EPS of $1.47. Comparable values for FY 2023 ending October 29th were net income of $792.9 million on revenue of $12,110 million with a diluted EPS of $1.45.

Effective October 2022, Hormel reorganized their operating divisions into Retail, Food Service and International segments. The Jennie-O Turkey Store Division was integrated among the three operating divisions. Accordingly, releases since Fiscal 2023 do not disclose either volume or cost data for this subsidiary as in previous years. In reviewing the release, there was only indirect comment on the turkey business noting higher volume for lean ground turkey meat through Retail and Jennie-O products in Food Service. The report noted a decline in exports of turkey products, impacting the International segment. There was no reference to the risk of HPAI in either the release or the Analysts’ call. The infection has and is impacting turkey flocks in Minnesota and the Dakotas. In previous analysts’ calls CEO Jim Snee expressed ongoing concern over losses during November and December 2023 and the spring wave in 2024.

Segment performance in both sales and operating profit for the most recent quarter was compared with Q4 FY 2023:-

- Retail Segment volume -6.0%: sales -4.0%: segment profit +2.9%.

- Food Service Segment volume +2.0%: sales +1.0%: segment profit -8.0%.

- International Segment volume -10.0%: sales +1.0%: segment profit +184.0%.

For FY 2025 the company projected net sales of $11,900 to $12,200 million (up $100 million) and an unchanged adjusted full year diluted net earnings per share in the range of $1.58 to $1.72.

In commenting on Q4 results, Jim Snee CEO and Chairman stated, “Fiscal 2024 demonstrated solid execution of our strategy, the power of our portfolio and the resilience of our team “Across our business segments, we reinvested in our brands, expanded our market presence and introduced innovative solutions to drive impactful results,”

Reviewing segment performance Snee noted "In Retail, our flagship and rising brands, such as Hormel® Black Label®, Jennie-O®, SPAM®, and Applegate®, delivered strong growth and expanded households. Our Foodservice segment again achieved above-industry growth, highlighting the differentiated value and relevant offerings our dedicated team brings to the industry. Our International results reflect a solid recovery, and we remain well positioned to continue expanding our global presence.” He added “The combination of underlying business strength and the capture of $75 million in operating income benefit from our Transform and Modernize (T&M) initiative helped to offset a dynamic consumer environment, the steep decline in whole bird turkey commodity markets, and the production disruption at our Suffolk, Virginia, facility."

He concluded, "The focus on our value-added portfolio, innovation, and T&M initiative has positioned us well for sustainable growth and enhanced shareholder value.”

Hormel Foods posted total assets of $13,435 million on October 27th 2024 of which $6,656 million comprised goodwill and intangibles. Long-term debt was $3,061 million against an intraday market capitalization of $18,080 million on December 16th. HRL has traded over the past 52 weeks in a range of $28.51 (an 8-year low) to $36.86 with a 50-day moving average of $31.25. HRL trades with a forward P/E of 19.4. HRL closed at $31.82 on December 3rd pre-release. The share price closed almost unchanged at $31.99 on December 4th post release

The 12-month trailing operating margin is 8.9 percent with a profit margin of 6.5 percent. The Company has returned 5.2 percent on assets and 10.0 percent on equity.

|

Plant-Based Meat Alternative Products Contaminated with Bacterial Pathogens

|

|

A recent survey conducted in Switzerland* disclosed bacterial contamination of plant-based meat alternatives sampled at retail by public health officials. Findings suggested the need to apply HACCP principles in the manufacture of plant-based products: A recent survey conducted in Switzerland* disclosed bacterial contamination of plant-based meat alternatives sampled at retail by public health officials. Findings suggested the need to apply HACCP principles in the manufacture of plant-based products:

- Six percent of the samples yielded Enterobacteriaceae.

- Seven percent were contaminated with Listeria spp. other than L monocytogenes but including L. innoculua and L. seeligeri. It is noted that there is a zero tolerance for Listeria in food products marketed in the U.S.

- Two percent of the samples were contaminated with Staphylococcus aureus ST8.

- Five percent of the samples yielded Bacillus cereus with all strains identified as potentially pathogenic.

It is assumed that the FDA, with jurisdiction over plant-based alternatives to meat are evaluating production facilities and conducting assays for heavy metals, other toxins and bacteria. Or do we just wait for a problem to emerge?

*Barmettler, K., et al, Microbiological Quality of Plant-Based Meat-Alternative Products Collected at Retail Level in Switzerland, J. Food Protection doi.org/10.1016/j.jfp.2024

|

Butterball to Close Jonesboro, AR Plant

|

|

On December 4th, Butterball LLC advised the state of Arkansas under a Worker Adjustment and Retraining Notification that the company will close the Jonesboro facility on February 3rd, 2025. The plant produces further-processed turkey products employing 180 workers. On December 4th, Butterball LLC advised the state of Arkansas under a Worker Adjustment and Retraining Notification that the company will close the Jonesboro facility on February 3rd, 2025. The plant produces further-processed turkey products employing 180 workers.

Jay Jandrain CEO of Butterball stated, “we deliberated for a long time about this difficult decision as we know it will affect team members and their families.” He added, “We are committed to helping our team members as they determine next steps in their careers.”

The decision by Butterball to close the facility and consolidate production in other plants follows rationalization and downsizing of facilities by Tyson Foods and other processors as a need to contain cost of production. Older plants that cannot be upgraded or expanded with installation of modern automated equipment to increase efficiency are obviously candidates for closure.

|

Center for Consumer Freedom Opposes End-run to Promote Lab-Grown Meat

|

|

Will Coggin representing the Center for Consumer Freedom recently appeared before the American Legislative Exchange Council, a group representing conservative state lawmakers. At issue was an attempt to solicit an endorsement by Food Solution Action, a lobbying group representing aspirant manufacturers of cell-cultured meat and plant-based alternative to real meat and poultry. This group presented a case for alternatives to real meat based on the principle of “consumer freedom”. Will Coggin representing the Center for Consumer Freedom recently appeared before the American Legislative Exchange Council, a group representing conservative state lawmakers. At issue was an attempt to solicit an endorsement by Food Solution Action, a lobbying group representing aspirant manufacturers of cell-cultured meat and plant-based alternative to real meat and poultry. This group presented a case for alternatives to real meat based on the principle of “consumer freedom”.

Lawmakers were not buying their presentation and voted against endorsing alternatives to real meat based on obvious safety concerns and the needs of their respective constituencies. Many conservative lawmakers with libertarian orientation represent supporters and voters engaged in beef, pork and poultry production. Politicians recognize that intensive livestock production makes Lawmakers were not buying their presentation and voted against endorsing alternatives to real meat based on obvious safety concerns and the needs of their respective constituencies. Many conservative lawmakers with libertarian orientation represent supporters and voters engaged in beef, pork and poultry production. Politicians recognize that intensive livestock production makes  available quality protein at an acceptable price, generates jobs and is integral to the agricultural economy of the U.S. available quality protein at an acceptable price, generates jobs and is integral to the agricultural economy of the U.S.

|

Workers Hospitalized After Exposure to Carbon Monoxide

|

|

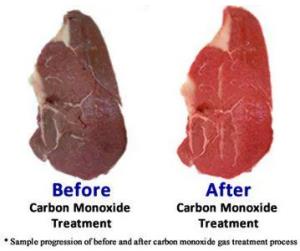

Eleven workers were hospitalized on December 7th after exposure to carbon monoxide at the Otto and Sons plant in West Jordan, UT. The Company is a subsidiary of OSI Industries, a major processor of meat products for institutional kitchens and major QSRs.

Carbon monoxide is used in packaging to deceptively enhance the red color of ground meat, possibly inhibit potential pathogens and questionably prolong shelf life, especially in case-ready products. Carbon monoxide is approved for use in the U.S. but is banned in Canada, Japan and the European Union.

Evidently a leak occurred in the plant, releasing carbon monoxide into the atmosphere of the work area. A number of employees complained of dizziness and one lost consciousness, resulting in a call to first responders. Fire crews determined that carbon monoxide readings in some parts of the plant attained 800 ppm. Generally, 35 ppm is considered to be the upper limit of short-term exposure  and requiring a breathing apparatus. Seventy ppm is extremely toxic, and prolonged exposure will reduce the oxygen carrying capacity of hemoglobin with potentially serious results. and requiring a breathing apparatus. Seventy ppm is extremely toxic, and prolonged exposure will reduce the oxygen carrying capacity of hemoglobin with potentially serious results.

It is evident that if carbon monoxide is used in a plant, appropriate monitors with alarm systems should be installed and tested at frequent intervals to allow for rapid evacuation of work areas should a leak occur. It is assumed that OSHA will investigate the

|

USDA Chicken Purchases

|

|

In a November 22nd release, USDA announced three sequential purchases of chicken products for child nutrition and related domestic food distribution programs. Purchases were made on November 15th, 19th and 20th, respectively, for delivery over the period January 1st, through March 31st, 2025. In a November 22nd release, USDA announced three sequential purchases of chicken products for child nutrition and related domestic food distribution programs. Purchases were made on November 15th, 19th and 20th, respectively, for delivery over the period January 1st, through March 31st, 2025.

In total, the three tranches amounted to 1,930 tons plus 52,128 cases with a total value of $14,205,883. Products included: - In total, the three tranches amounted to 1,930 tons plus 52,128 cases with a total value of $14,205,883. Products included: -

- Frozen non-breaded chicken fillets at $2.71 per lb.

- Frozen chicken strips at $2.29 per lb.

- Cut-up frozen chicken at $2.03 per lb.

- Frozen bagged whole chicken at $1.01 per lb.

- Canned boned chicken at $2.38 per lb.

|

Smithfield Foods Relinquishes Live Hog Production to Murphy Family Ventures

|

|

Smithfield Foods has negotiated an agreement with Murphy Family Ventures to assume ownership of 150,000 sows and their progeny to produce 3.2 million hogs of market weight annually for packaging. Under the agreement Smithfield will provide feed, transportation and services with Murphy Family Ventures serving as the contract entity.

Dell Murphy president and CEO of Murphy Family Ventures noted, “Our family has enjoyed the past 24 years as a contract growing partner with Smithfield and we look forward to restoring our heritage as an independent producer.” Shane Smith, CEO of Smithfield Foods noted that the agreement was consistent with the intention of his Company to focus on consumer products. He stated, “With this agreement we continue the transformation while ensuring a supply of hogs from a family farming operation with a long history and strong commitment to best practices.”

|

|

Tyson to Close Emporia, KS. and Philadelphia, PA. Plants

|

|

Following a program of consolidation to improve earnings, Tyson Foods will close the Emporia, KS plant, displacing 800 workers. This action follows the closure of six chicken plants and an Iowa pork plant. Following a program of consolidation to improve earnings, Tyson Foods will close the Emporia, KS plant, displacing 800 workers. This action follows the closure of six chicken plants and an Iowa pork plant.

The Emporia plant produces seasoned, marinated meats and ground beef and is anticipated that production in Emporia will be transferred to the Holcombe KS plant.

Tyson will close two plants acquired in 2017 from Original Philly Holdings located in north Philadelphia. The plants that employ in the region of 250 workers produce sandwiches and appetizers under the Original Philly Cheesesteak brand.

The latest announcements follow closure of six chicken complexes over 12 months in a program of rationalization and consolidation to reduce operating costs.

|

McDonald’s to Bring Back Snack Wraps

|

|

Joe Erlinger president of McDonald’s USA confirmed that his company will reintroduce the Snack Wrap following consumer demand evidenced by a petition signed by 18,000 and a social media campaign urging reintroduction. Joe Erlinger president of McDonald’s USA confirmed that his company will reintroduce the Snack Wrap following consumer demand evidenced by a petition signed by 18,000 and a social media campaign urging reintroduction.

This menu item was introduced in 2006 with beef and chicken options although nine varieties were offered. The beef version was dropped in 2013 followed by chicken in 2016 although some franchises continued marketing the product through 2020. Snack Wraps were terminated based on low sales and the length of time required to steam the tortilla and to stuff the wraps. This menu item was introduced in 2006 with beef and chicken options although nine varieties were offered. The beef version was dropped in 2013 followed by chicken in 2016 although some franchises continued marketing the product through 2020. Snack Wraps were terminated based on low sales and the length of time required to steam the tortilla and to stuff the wraps.

McDonalds is hoping that the popularity of wraps will increase traffic.

|

Jennie-O Expanding Willmar, MN. Plant

|

|

Hormel Foods Corp, the holding company for Jennie-O, Turkey Store has announced an expansion program to add 20,000 square feet of space to their Willmar, MN. plant. The project will be completed during the fourth quarter of 2025 and will include modernization of equipment to improve efficiency and to expand product range to include additional value-added items. Hormel Foods Corp, the holding company for Jennie-O, Turkey Store has announced an expansion program to add 20,000 square feet of space to their Willmar, MN. plant. The project will be completed during the fourth quarter of 2025 and will include modernization of equipment to improve efficiency and to expand product range to include additional value-added items.

|

United Natural Foods Subject of Class Action Lawsuit

|

|

United Natural Foods, a major wholesale distributor was the subject of a lawsuit filed by NYSM Organics of Vineyard Haven, MA. The complaint filed in the Superior Court of Rhode Island charges UNFI with breach of contract arising from unjust use of prompt-paid discounts. The plaintiff alleges “intentional and systematic but unjustified discounts despite withholding payments on supplier invoices.” United Natural Foods, a major wholesale distributor was the subject of a lawsuit filed by NYSM Organics of Vineyard Haven, MA. The complaint filed in the Superior Court of Rhode Island charges UNFI with breach of contract arising from unjust use of prompt-paid discounts. The plaintiff alleges “intentional and systematic but unjustified discounts despite withholding payments on supplier invoices.”

The complaint apparently disclosed discriminatory practices against small suppliers.

In rebutting the claim, UNFI stated, “We value all our supplier relationships and take any concerns seriously.”

For the most recently concluded FY2024 ending August 3rd UNFI posted a loss of $112 million on sales of $30,980 million with a negative EPS of $(1.89). Comparable values for FY 2023 were earnings of $24 million on sales of $30,272 million with an EPS of $0.40.

|

Beyond Meat Settles False Claim Lawsuit

|

|

Beyond Meat (BYND) has agreed to settle a 2022 lawsuit claiming false and misleading promotion and deceptive business practices. The company falsely claimed superior nutritional content of its products compared to animal-derived meat. Beyond Meat claimed higher availability of amino acids from plant-based protein compared to animal-derived products. Beyond Meat (BYND) has agreed to settle a 2022 lawsuit claiming false and misleading promotion and deceptive business practices. The company falsely claimed superior nutritional content of its products compared to animal-derived meat. Beyond Meat claimed higher availability of amino acids from plant-based protein compared to animal-derived products.

Beyond Meat will not admit to wrongdoing but will pay the plaintiff class $7.5 million subject to a January 2025 settlement hearing.

In past months, Beyond Meat has shifted its promotional message from the original focus on welfare and sustainability to health in an attempt to stimulate consumer demand. Given the financial performance of the company characterized by declining sales, it is questioned whether the current sales strategy can move the needle. Beyond Meat products lack acceptability based on price compared to equivalent real meat and quality is inferior including appearance and texture when cooked.

|

Value of USDA MCap Grants

|

|

The outgoing USDA administration recently announced grants amounting to $20 million for 26 projects under the Local Meat Capacity (MCap) Program. To date, USDA has funded 97 projects valued at $56 million under this initiative. The objective of the program is to support small-scale and regional livestock production and processing to increase options for farmers. The program is justified by an internal USDA report Competition and Fair Practice in Meat Merchandizing that claims to lower food prices and to assist livestock producers and ranchers. The outgoing USDA administration recently announced grants amounting to $20 million for 26 projects under the Local Meat Capacity (MCap) Program. To date, USDA has funded 97 projects valued at $56 million under this initiative. The objective of the program is to support small-scale and regional livestock production and processing to increase options for farmers. The program is justified by an internal USDA report Competition and Fair Practice in Meat Merchandizing that claims to lower food prices and to assist livestock producers and ranchers.

Over the past four years, USDA has attempted to restructure meat and poultry production using funding from the Inflation Reduction Act and dipping into the Commodity Credit Corporation piggy bank.

What is important is the magnitude of ultimate benefits to both producers and consumers through funding euphemistically referred to as “investment.” USDA has yet to demonstrate or to quantify a return on the use of public funds or to account for expenditures under diverse ‘giveaway’ programs.

|

E. coli Outbreak Implicates Wolverine Packing Company

|

|

The Minnesota Department of Health and USDA-FSIS have confirmed a cluster of cases of E. coli O157:H7 infection among customers consuming burgers at two Minneapolis restaurants. Traceback from cases over the period November 2nd through 10th implicated Wolverine Packing Company as the supplier of the burger patties.

Accordingly, the Company has issued a recall for product with a “use by” date of November 14th amounting to 80 tons of product. The magnitude of the recall is in all probability due to the packing company being unable to identify specific batches of contaminated product resulting in an extensive recall to include all ground meat that may possibly have been contaminated.

|

|

|

|

|

Maple Leaf Foods and Grupo Bimbo Litigating over Defamation

|

|

I n January 2016 the Competition Bureau of Cananda investigated alleged price-fixing in the bread industry extending from 2001 through March 2015. As a result, Canada Bread a subsidiary of Grupo Bimbo SAB de CV paid a fine of US$35 million. n January 2016 the Competition Bureau of Cananda investigated alleged price-fixing in the bread industry extending from 2001 through March 2015. As a result, Canada Bread a subsidiary of Grupo Bimbo SAB de CV paid a fine of US$35 million.

Canada Bread was acquired by Grupo Bimbo in 2014 at which time Maple Leaf owned 90 percent of the voting stock. Recently Maple Leaf Foods alleged that Canada Bread defamed Maple Leaf Foods, a shareholder and major meat packer in published statements.

It is anticipated that the Maple Leaf claim and counterclaims by Canada Bread will continue at considerable expense until settled, with the probability of degrading the corporate image of both parties.

|

Contribution of Cornell University to the Centerpiece of Festive Meals

|

|

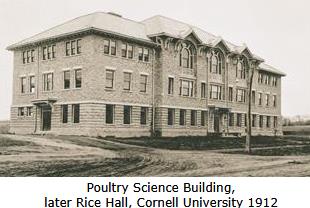

EGG-NEWS is indebted to Corey Earle for a review of the Cornell Poultry Science Program recently published in an alumni newsletter.

Professor James Rice, who graduated in 1890, submitting a thesis on poultry production, was appointed to the faculty of the Land Grant University. He established a teaching program in poultry production in 1892. Rice was a giant among the early promoters of poultry, organizing a judging school, establishing teaching and extension programs culminating in the establishment of the first poultry-dedicated department in the U.S. His activism and the importance of the emerging poultry industry in the Northeast led to the erection of a poultry science building in 1912, subsequently dedicated in his honor as Rice Hall.

During the early 1940s, Cornell established a turkey farm with Professor Earl Smith as the Director. He established a breeding program to develop a meat turkey. His hybrid was based on a cross between the White-Holland breed and the Broad-Breasted Bronze to create the Empire White, the first of the turkeys with a broad breast. Smith also developed artificial insemination due to the dimorphism of toms and hens. The Empire White debuted in 1953 and was used extensively by the industry. Additional refinement resulted from scientific breeding programs incorporating index selection and biomarkers for desirable traits.

Food scientists, including Dr. Bob Baker, were instrumental in developing further processed products both for eggs and turkeys that contributed to the early success of the U.S. poultry industry. Food scientists, including Dr. Bob Baker, were instrumental in developing further processed products both for eggs and turkeys that contributed to the early success of the U.S. poultry industry.

|

Qvest Allegedly Involved in Employing Underaged Workers

|

|

The U.S. Department of Labor (DOL) accused Qvest LLC of hiring underaged workers for cleaning services at the Seaboard Triumph Foods plant in Sioux City, IA. The alleged contraventions occurred between September 2019 and 2023. The Department of Labor accused Qvest of violating the Fair Labor Standards Act by employing 11 minors to clean dangerous equipment during a night shift. Qvest settled with the DOL paying a penalty of $171,000 and required the Company to hire a compliance officer and conduct appropriate training. The Agreement binds Fayette Janitorial Services that acquired the contract in 2023 continuing the illegal practice of employing underage workers. The U.S. Department of Labor (DOL) accused Qvest LLC of hiring underaged workers for cleaning services at the Seaboard Triumph Foods plant in Sioux City, IA. The alleged contraventions occurred between September 2019 and 2023. The Department of Labor accused Qvest of violating the Fair Labor Standards Act by employing 11 minors to clean dangerous equipment during a night shift. Qvest settled with the DOL paying a penalty of $171,000 and required the Company to hire a compliance officer and conduct appropriate training. The Agreement binds Fayette Janitorial Services that acquired the contract in 2023 continuing the illegal practice of employing underage workers.

Seaboard Triumph was not accused of wrongdoing as it did not employ any of the underaged workers. In a statement, Seaboard Triumph that “it will not tolerate any vendor’s use of underage labor within its facilities.” Currently cleaning services are provided by members of the United Food and Commercial Workers International Union.

Employment of underage and in some cases illegal immigrant workers to clean plants has been a subject of investigation involving numerous packers. The DOL documented 4,000 violations in 736 facilities from 2023 to date involving $15 million in penalties

Although operators of packing plants claim innocence through the use of third-party contractors, they have a moral and managerial obligation to ensure that obviously underaged workers are not present or performing prohibited work in their plants. Difficulty in relying on contractors to adhere to state and federal regulations and evident risk to corporate image and reputation resulted in JBS USA undertaking cleaning services within the company.

|

Agricultural Sector Concerned Over Threat of Mass Deportation of Illegal Immigrants

|

|

President-elect Donald J. Trump has threatened to deport all illegal immigrants both in his pre-election rhetoric and in subsequent statements and social media posts. The USDA estimates that half of the nation’s two million farm workers lack legal status. President-elect Donald J. Trump has threatened to deport all illegal immigrants both in his pre-election rhetoric and in subsequent statements and social media posts. The USDA estimates that half of the nation’s two million farm workers lack legal status.

Dave Puglia, President of Western Growers, noted that production will be seriously impacted if illegal workers were to be deported. Representative John Duarte (R-CA), currently awaiting the result of his reelection bid, commented that his constituency, which includes the Central Valley, was dependent on illegal immigrants and that serious economic consequences would follow mass deportation. Green produce, dairy and meat-packing companies would be adversely affected if workers were to be deported.

Tom Homan, appointed to secure the Southern border and to implement a program of deportation, has indicated that the priority will be illegal immigrants with criminal records or involvement with law enforcement in the U.S.

Given that a significant proportion of U.S. citizens, many receiving SNAP and other federal and state benefits, are disinclined to perform agricultural labor, it will be necessary to extend the program of H-2A visas. This will regularize the employment situation and allow workers to enter the U.S. to perform agricultural labor without displacing U.S. citizens and permanent residents.

During the first Administration of President Trump, there was only limited action against illegal workers including a few raids on poultry processing plants in Mississippi and produce-packing facilities in Nebraska.

|

Consumer Digest Survey Shows Preference for Turkey as Centerpiece of Thanksgiving Meal

|

|

Despite news reports indicating that consumers are moving away from turkey as the main protein for Thanksgiving celebrations, a Consumer Digest survey confirmed the popularity of roast turkey. The survey involved 400 Kroger consumers over the three months prior to Thanksgiving showed that turkey was overwhelmingly favored as the centerpiece. Of those surveyed, 81 percent planned turkey as their main protein with ham at 7 percent and chicken at 3 percent. Despite news reports indicating that consumers are moving away from turkey as the main protein for Thanksgiving celebrations, a Consumer Digest survey confirmed the popularity of roast turkey. The survey involved 400 Kroger consumers over the three months prior to Thanksgiving showed that turkey was overwhelmingly favored as the centerpiece. Of those surveyed, 81 percent planned turkey as their main protein with ham at 7 percent and chicken at 3 percent.

It was disconcerting to note that 11 percent of respondents had no plans to celebrate Thanksgiving in 2024. This was perhaps a reflection of family fragmentation, the growing wave of loneliness and possibly cost considerations. It was disconcerting to note that 11 percent of respondents had no plans to celebrate Thanksgiving in 2024. This was perhaps a reflection of family fragmentation, the growing wave of loneliness and possibly cost considerations.

Reflecting convenience, 13 percent of the respondents planned to purchase complete meals, encouraged by advertisements by supermarket chains for special Thanksgiving meal kits with both ingredients and instructions. Many retail chains offered prepared meals to serve up to ten diners.

|

Death Toll Rises in Yu Shang Listeria Outbreak

|

|

According to a posting on ProMED Mail cases of listeriosis were attributed to consuming prepared meals produced by Yu Shang Food, Inc. Of 11 diagnosed cases nine required hospitalization. One case involved a pregnant woman and her twins both of whom dyed. Cases were reported in California, Illinois, New Jersey and New York. As with many foodborne outbreaks, the actual number of those infected is higher than the confirmed cases. Traceback and identification of the source of Listeria infection is complicated by the prolonged incubation period that may extend to 70 days. According to a posting on ProMED Mail cases of listeriosis were attributed to consuming prepared meals produced by Yu Shang Food, Inc. Of 11 diagnosed cases nine required hospitalization. One case involved a pregnant woman and her twins both of whom dyed. Cases were reported in California, Illinois, New Jersey and New York. As with many foodborne outbreaks, the actual number of those infected is higher than the confirmed cases. Traceback and identification of the source of Listeria infection is complicated by the prolonged incubation period that may extend to 70 days.

Pregnant women and their infants, the immunosuppressed and elderly are more susceptible to listeriosis than healthy individuals. In this outbreak, the age of patients ranged from less than one year of age to 86 years. All cases were of Asian ethnicity consistent with the products distributed by Yu Shang Foods. The vehicle of infection was confirmed to be ready-to-eat chicken products. Investigations showed that processed pork snouts were contaminated with Listeria suggesting the presence of the pathogen in the environment and equipment of the plant of origin. Pregnant women and their infants, the immunosuppressed and elderly are more susceptible to listeriosis than healthy individuals. In this outbreak, the age of patients ranged from less than one year of age to 86 years. All cases were of Asian ethnicity consistent with the products distributed by Yu Shang Foods. The vehicle of infection was confirmed to be ready-to-eat chicken products. Investigations showed that processed pork snouts were contaminated with Listeria suggesting the presence of the pathogen in the environment and equipment of the plant of origin.

On November 9th, Yu Shang Food recalled ready-to-eat meat and poultry products with a further expansion to a total recall in late November.

|

Koch Foods to Upgrade Morton, MS. Facility

|

|

According to a company release, Koch Foods will invest $145 million to upgrade the Morton, MS. plant funding an expansion and installation of modern equipment. According to a company release, Koch Foods will invest $145 million to upgrade the Morton, MS. plant funding an expansion and installation of modern equipment.

Part of the cost will be borne through the Mississippi Flexible Tax Incentive Program. Part of the cost will be borne through the Mississippi Flexible Tax Incentive Program.

Koch Foods, based in Park Ridge, IL, operates across a broad area of the Southeast with facilities in Alabama, Georgia, Mississippi in addition to Ohio and Tennessee.

|

Quality and Taste Significant in Consumer Choice of Meat Products

|

|

According to a recent publication*, a survey conducted by Rutgers, Columbia and Cornell University in collaboration with the International Food Policy Research Institute reported on the motivators for selection of meat products based on perceived attributes. A sample of 1,224 U.S. adults conducted in 2021 clearly demonstrated the value of quality and taste with health intermediate but revealing indifference towards environmental sustainability and animal welfare.

The study was conducted to rank motivators determining purchase to ascertain whether reducing meat consumption could benefit the environment.

The significant motivators and their relative rankings were:-

- Environmental Sustainability 29%

Among those rating environmental sustainability, 30% characterized the attribute as “not very important” and 36% “somewhat important”. Among the respondents rating animal welfare, 36% regarded the attribute as “not very important” and 32% as “somewhat important”.

Among participants in the survey, 78 percent consumed red meat one to four times per week and 79 served poultry with the proportions influenced by socioeconomic status. There was a trend towards reducing red meat with 70% declaring lower consumption as opposed to 34% reducing poultry intake. This may reflect either health considerations or cost given the availability of both categories of animal-derived proteins in U.S. supermarkets. Considerations of environmental sustainability and animal welfare were less important motivators in reducing meat intake.

Principal investigator, Dr. Shauna Downs of the Rutgers School of Public Health stated, “Our findings suggest that messaging focused solely on sustainability may not resonate with U.S. consumers regarding their meat choices.”

*Downs, S. et al Sustainability considerations are not influencing meat consumption in the U.S. Appetite. 203: December 1, 2024, doi.org/10.1016/j.appet.2024.207667

|

Unilever Divests Vegetarian Butcher Subsidiary

|

|

Unilever has undertaken a program of divesting non-core businesses and brands in a move to rationalize products in diverse markets. The most recent action in this regard is a decision to sell the Vegetarian Butcher producing plant-derived meat that in all probability is not generating a return on investment commensurate with company standards.

Unilever has commissioned an investment bank to assist in the disposal of the business with a number of prospective purchasers identified.

|

U.S. Suspends Importation of Live Animals from Mexico

|

|

Following an outbreak of New World screwworm (Cochliomyia hominivorax) in the Mexican state of Chiapas near the border with Guatemala, the U.S. APHIS has halted importation of live cattle from Mexico awaiting a response from the Government of Mexico. Following an outbreak of New World screwworm (Cochliomyia hominivorax) in the Mexican state of Chiapas near the border with Guatemala, the U.S. APHIS has halted importation of live cattle from Mexico awaiting a response from the Government of Mexico.

New World screwworm was eradicated from North America in 2006, with a barrier represented by the Panama Canal blocking northward spread of the parasite. Elimination was achieved by releasing irradiated sterile flies and tactical administration of insecticides coupled with surveillance of livestock. Recently illegal movement of cattle and failure to regulate livestock has allowed northward movement of the infestation with transfer of infective eggs and larvae on cattle from Nicaragua to Mexico.

Based on the import ban, cattle producers in Mexico are pressing their authorities for immediate action to prevent illegal movement of livestock from Guatemala to Mexico. Action includes strengthening enforcement at border crossings, increasing penalties for illegal livestock movement and encouraging collaboration between government authorities and stakeholders.

The magnitude of trade between Mexico and the U.S. is evidenced by importation of 89,000 head in October with a 13 percent year-to-date increase in introduction of feeder cattle from Mexico compared to 2023. magnitude of trade between Mexico and the U.S. is evidenced by importation of 89,000 head in October with a 13 percent year-to-date increase in introduction of feeder cattle from Mexico compared to 2023.