Monthly Broiler Production and Prices, December 2024.

Broiler Chick Placements.

According to the December 18th 2024 USDA Broiler Hatchery Report, 990.42 million eggs were set over four weeks extending from November 23rd 2024 through December 14th 2024 inclusive. This was three percent higher compared to the corresponding period in 2023.

Total chick placements for the U.S. over the five-week period amounted to 764.16 million chicks. Claimed hatchability for the period averaged 79.7 percent for eggs set three weeks earlier, unchanged from the preceding five-week period. Each 1.0 percent change in hatchability represents approximately 1.91 million chicks placed per week and 1.82 million broilers processed, assuming five percent culls and mortality and with the current range of weekly settings.

Cumulative chick placements for the period January 7th through December 30th 2023 amounted to 9.67 billion chicks. For January 6th through December 14th 2024 chick placements attained 9.46 billion, up two percent from the corresponding week in 2023.

According to the December 20th 2024 edition of the USDA Chickens and Eggs, pullet breeder chicks hatched and intended for U.S. placement during November 2024 amounted to 8.26 million, up 0.7 percent (56,000 pullet chicks) from November 2023 and 2.5 percent (205,000 pullet chicks) more than the previous month of October 2024. Broiler breeder hen complement attained 60.88 million on November 1st 2024, 2.7 percent (1.74 million hens) less than on November 1st 2023.

Broiler Production

As documented in the December 20th 2024 USDA Broiler Market News Reports for the processing week ending December14th 2024, 166.6 million broilers were processed at 6.53 lbs. live. This was 1.9 percent less than the 169.9 million broilers processed during the corresponding week in the previous month of November 2024 and 0.6 percent less than the 167.6 million processed during the corresponding week in December 2023. Broilers processed in 2024 to date amounted to 8,200 million, 1.3 percent lower than for the corresponding period in 2023.

Ready to cook (RTC) weight for the most recent week in December was 830.8 million lbs. (377,639 metric tons). This was 1.8 percent less than the 845.9 million lbs. processed during the corresponding week in November 2024 and 0.8 percent more than the 824.1 million lbs. during the corresponding week in December 2023. Dressing percentage was a nominal 76.0 percent. For 2024 to date RTC broiler production attained 40,607 million lbs. (18.46 million metric tons). This quantity was 0.6 percent more than for the corresponding period in 2023.

Broiler Prices

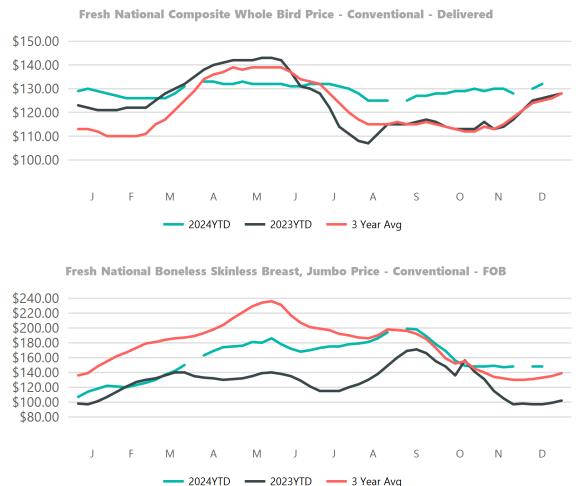

The USDA National Composite Weighted Wholesale price for the week ending December 20th 2024 was up 4.6 cents per lb. to 132.6 cents per lb. from the corresponding week in November 2024. The attached USDA figures denote average prices over three-years.

Leading QSRs are using increasing quantities of breast meat for sandwiches, strips and nuggets. Inflation is increasing consumer awareness of value with chicken benefitting at the expense of beef and pork

The USDA National benchmark prices in cents per lb. (rounded to nearest cent) are tabulated from the USDA Weekly National Chicken Report released on December 20th 2024.

|

Product

|

USDA Dec. 20th

2024

Cents/lb.

|

USDA

Nov. 22nd

2024

Cents/lb.

|

Difference.

%

|

|

Whole

|

133

|

128

|

+3.9

|

|

MSC

|

25

|

25

|

Unchanged

|

|

B/S Breast

|

148

|

148

|

Unchanged

|

|

Whole Breasts

|

107

|

107

|

Unchanged

|

|

B/S Thighs

|

155

|

159

|

-2.5

|

|

Whole Thighs

|

95

|

94

|

-1.1

|

|

Drumsticks

|

48

|

48

|

Unchanged

|

|

Leg Quarters

|

51

|

52

|

-1.9

|

|

Wings (whole)

|

189

|

189

|

Unchanged

|

The USDA posted live-weight data for the past week ending December 16th and YTD 2024 were:-

|

Live Weight Range (lbs.)

|

<4.25

|

4.26-6.25

|

6.26-7.25

|

>7.76

|

|

Proportion past week (%)

|

19

|

26

|

26

|

29

|

|

Change from 2020 YTD (%)

|

-1

|

-4

|

-2

|

+3

|

During the week ending December 14th 2024 broilers for QSR and food service (live, 3.6 lb. to 4.3 lb.) represented 19 percent of processed volume up 5 percent from the corresponding week in October 2024.

On December 16th 2024 cold storage holdings of processed poultry other than chicken at selected centers amounted to 64,237 lbs. 5.1 percent more than the inventory of 61,118 lbs. on December 1st 2024.

November 2024 Frozen Inventory

According to the December 23rd 2024 USDA Cold Storage Report, issued monthly, stocks of broiler products as of November 30th 2024 compared to November 30th 2023 showed differences with respect to the following categories:-

- Total Chicken category attained 810.4 million lbs. (368,364 metric tons) corresponding to approximately 1.1 week of production based on recent weekly RTC output. The November 30th 2024 inventory was down 8.0 percent compared to 880,520 million lbs. (400,236 metric tons) on November 30th 2023 and up 0.7 percent from the previous month of October 2024.

- LegQuarters were down by 6.5 percent to 66.2 million lbs. compared to November 30th 2023 consistent with the data on exports. Inventory was up 3.0 percent from October 31st Given the trend in inventory of leg quarters it is evident that this category continues to be shipped in varying quantities as the principal (97 percent) chicken export product to a number of nations with Mexico the leading importer.

- The Breasts and Breast Meat category was down 2.0 percent from November 30th 2023 to 234.65 million lbs. indicating a relatively constant domestic consumer demand despite concern over inflation in the cost of protein. November 30th 2024 stocks were 2.9 percent higher than on October 31st 2024 suggesting slightly lower retail and food service demand for this category despite promotion of chicken sandwiches by QSRs in the face of higher cost for beef and a stable to increasing pattern of eat-at-home consumption.

- Total inventory of dark meat (drumsticks legs, thighs and thigh quarters but excluding leg quarters) on November 30th 2024 decreased 14.1 percent from November 30th 2023 to 68.94 million lbs. This difference suggests an increase in domestic demand for lower-priced dark meat against the prevailing price of white chicken meat.

- Wings showed a 13.9 percent decrease from November 30th 2023, contributing to a stock of 59.1 million lbs. This category was 7.8 percent lower compared to October 31st Movement in stock over the past 12 months has demonstrated growth in demand for this category despite competition from “boneless wings.” Increased consumption traditionally associated with significant sports events including the College Bowl and Super Bowl reduced the volumes of storage in January and February 2024. The draw down from March Madness was evident in the May Report. The progressive increase in unit price during 2024 to date will plateau in 2025 due to consumer fatigue and competition from competing protein snacks despite continued interest in professional and collegiate football.

- The inventory of Paws and Feet was 17.6 percent higher than on November 30th 2023 to 32.0 million lbs. but inventory was 8.4 percent lower than on October 31st Prior to the April 2020 Phase-1 Trade Agreement approximately half of the shipments of paws and feet destined for Hong Kong were landed and transshipped to the Mainland, a trend that is re-emerging. During 2023, 405,313 metric tons of U.S. broiler products were shipped to China, valued at $711,172 with an average unit value of $1,755 per metric ton. A breakdown of product categories and prices provided by USAPEEC confirmed that Paws and Feet represented 68.5 percent of volume and 73.1 percent of value with a unit price of $1,871 per metric ton.

- The Other category comprising 334.4 million lbs. on November 30th 2024 was down 11.0 percent from November 30th 2023 but represented a substantial 41.3 percent of inventory. The high proportion of the Other category suggests further classification or re-allocation by USDA to the designated major categories.

|

November Broiler 2024 Production

The USDA Poultry Slaughter Report released on December 23rd 2024 covered November 2024 comprising 22 working days, one more than November 2023. The following values were documented for the month:-

- A total of 727.9 million broilers were processed in November 2024, down 33.9 million or 4.5 percent from November 2023;

- Total live weight in November 2024 was 4,828 million lbs., down 209.9 million lbs. or 4.2 percent from November 2023;

- Unit live weight in November 2024 was 6.63 lbs., up 0.02 lb. (0.3 percent) from November 2023.

- RTC in November 2024 attained 3,650 million lbs., down 167.71 million lbs. or 4.4 percent from November 2023.

- WOG yield in November 2024 was 75.6 percent, down from 75.8 percent in November 2023.

- The proportion marketed as chilled in November 2024 comprised 93.5 percent of RTC output compared to 94.3 percent in November 2023.

- Ante-mortem condemnation as a proportion of live weight attained 0.18 percent during November 2024 down from 0.19 percent in November 2023.

- Post-mortem condemnations as a proportion of processed mass corresponded to 0.45 percent during November 2024 compared to 0.44 percent in November 2023.

Comments

For 2023 exports of broiler parts and feet combined attained a volume of 3,635,178 metric tons (3,794,328 metric tons in 2022) with a value of $4,739 million ($5,217 million in 2022). Unit value decreased 5.2 percent from 2022 to $1,304 per metric ton (including feet) from $1,375 per metric ton.

Mexico has recognized the OIE principle of regionalization after intensive negotiations between SENASICA and U.S. counterpart, the USDA-APHIS assisted by USAPEEC. Provided importing nations adhere to OIE guidelines on regionalization, localized outbreaks of avian influenza and Newcastle disease will affect exports from states with outbreaks in commercial flocks. The response of China, Japan and some other nations is more predictable with bans placed on a statewide basis. The response by China to outbreaks is influenced more by self-interest than considerations of scientific fact or international trade obligations. Other importing nations have confined restrictions to counties following the WOAH principle of regionalization. The challenge facing exporting nations will be to gain acceptance for controlled vaccination against HPAI in specific industry sectors and regions with appropriate surveillance and certification to the satisfaction of importing nations.

Collectively our NAFTA/USMCA neighbors imported broiler products to the value of $1,175 million in 2021, $1,256 million in 2022 stabilizing in 2023 at $1,246 million.

The top five importers of broiler meat represented 46.3 percent of shipments during January-September 2024. The top ten importers comprised 65.3 percent of the total volume reflecting concentration among the significant importing nations.

The USDA December projection for RTC broiler production for 2025 will be 47,925 million lbs. with a per capita consumption of 103.3 lbs. Exports amounting to 6,795 million lbs. will represent 14.2 percent of production.